|

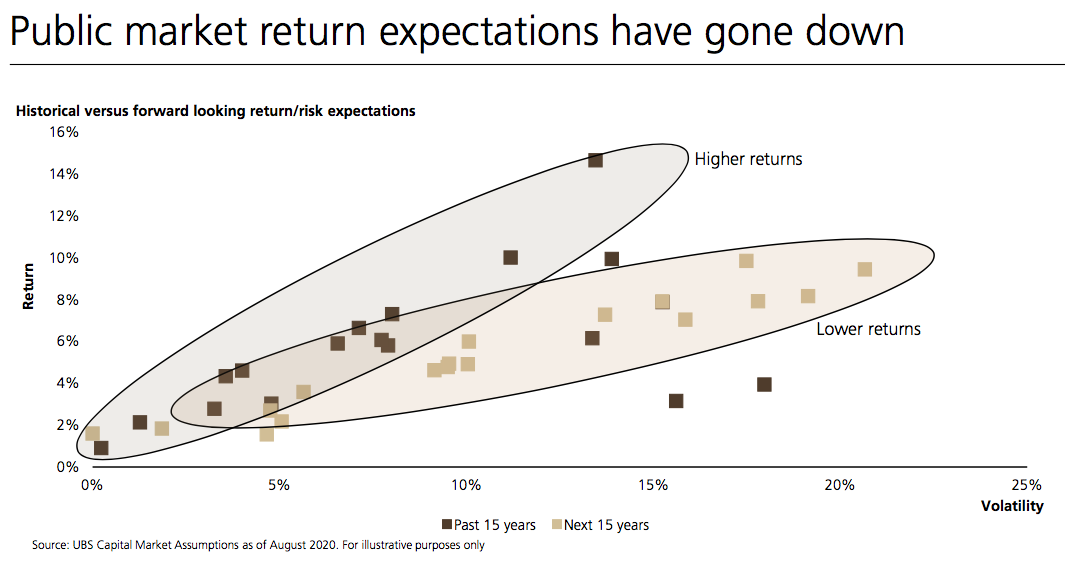

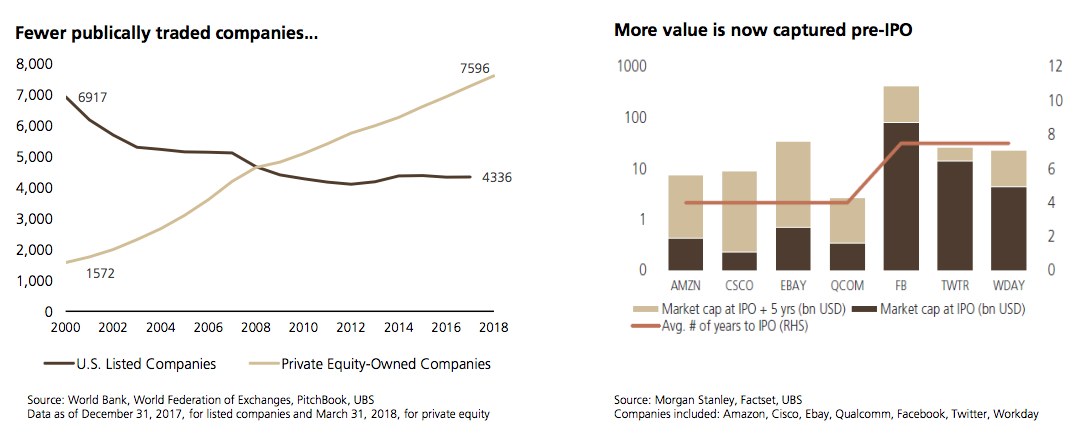

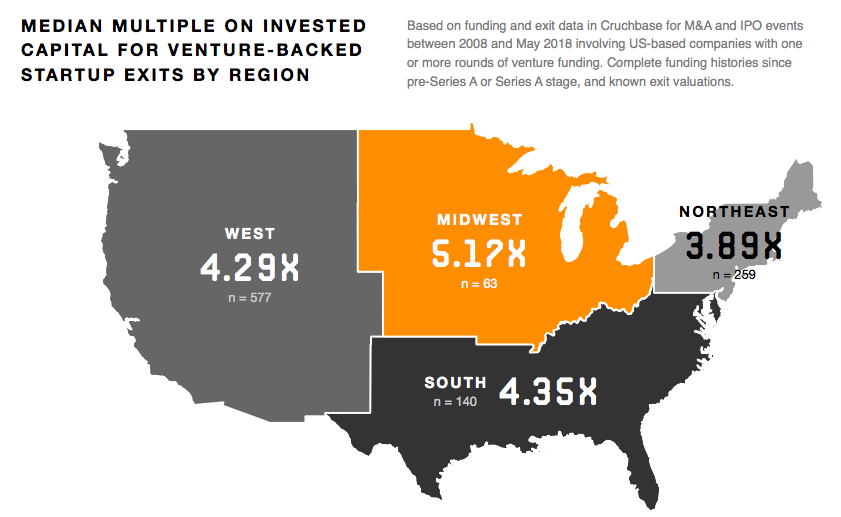

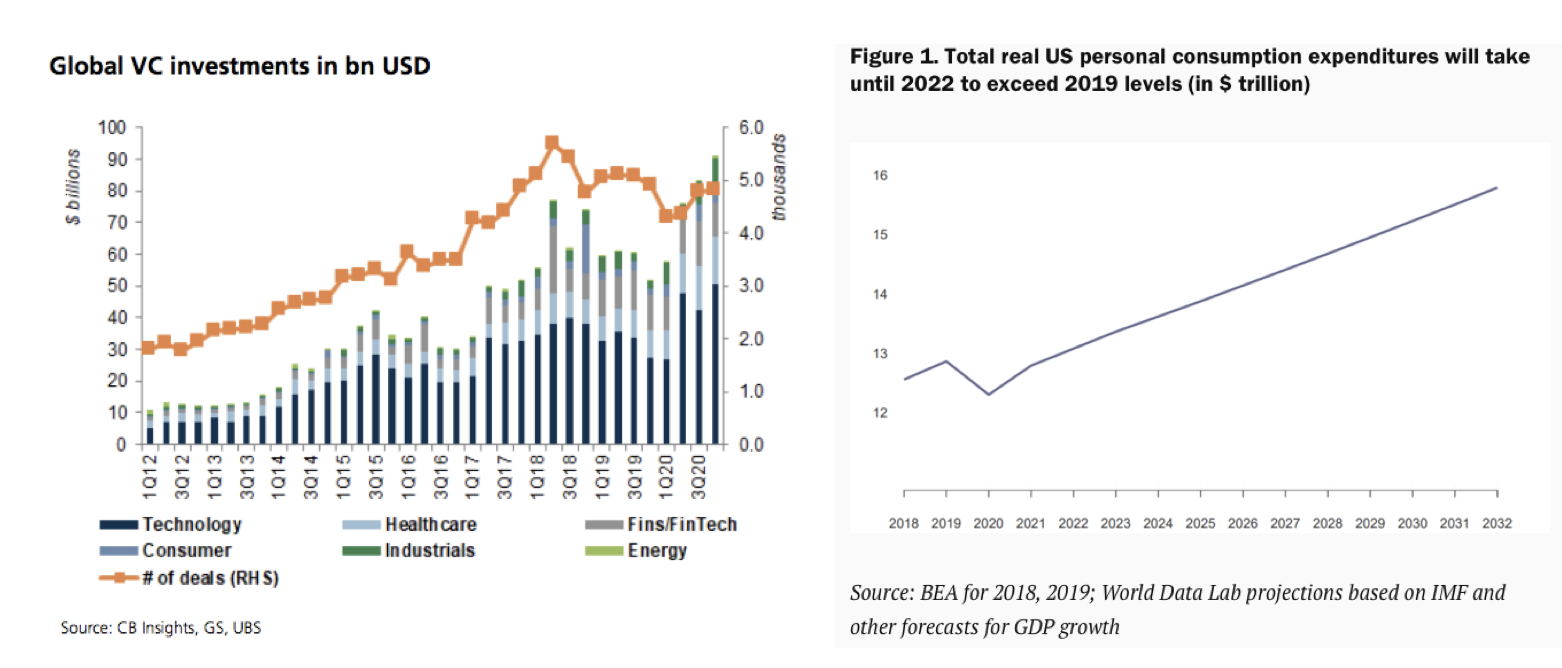

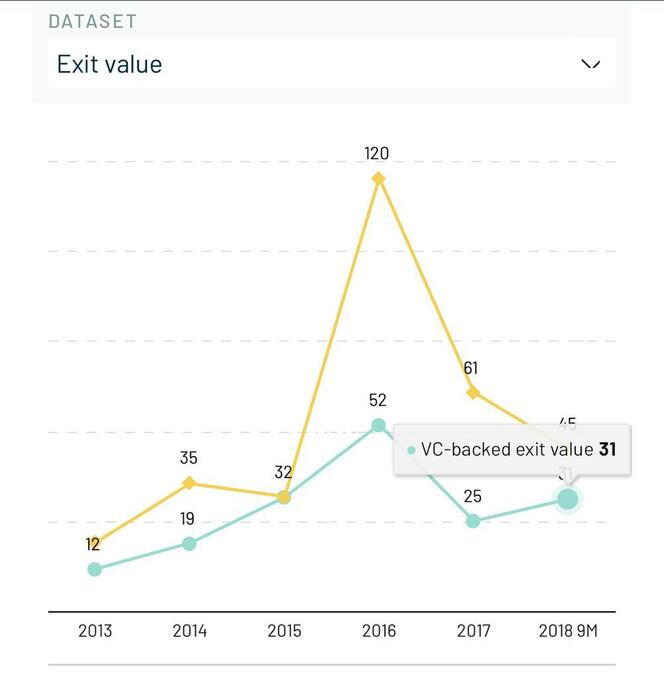

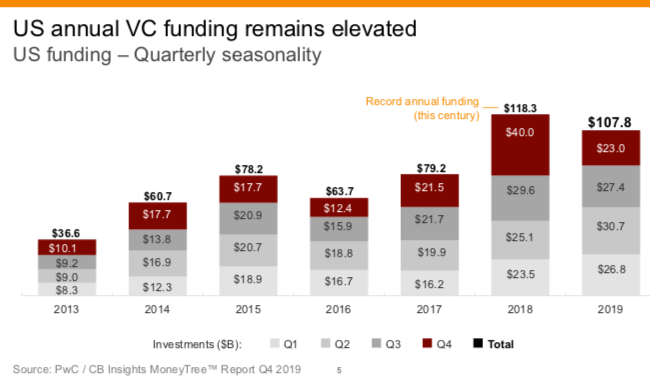

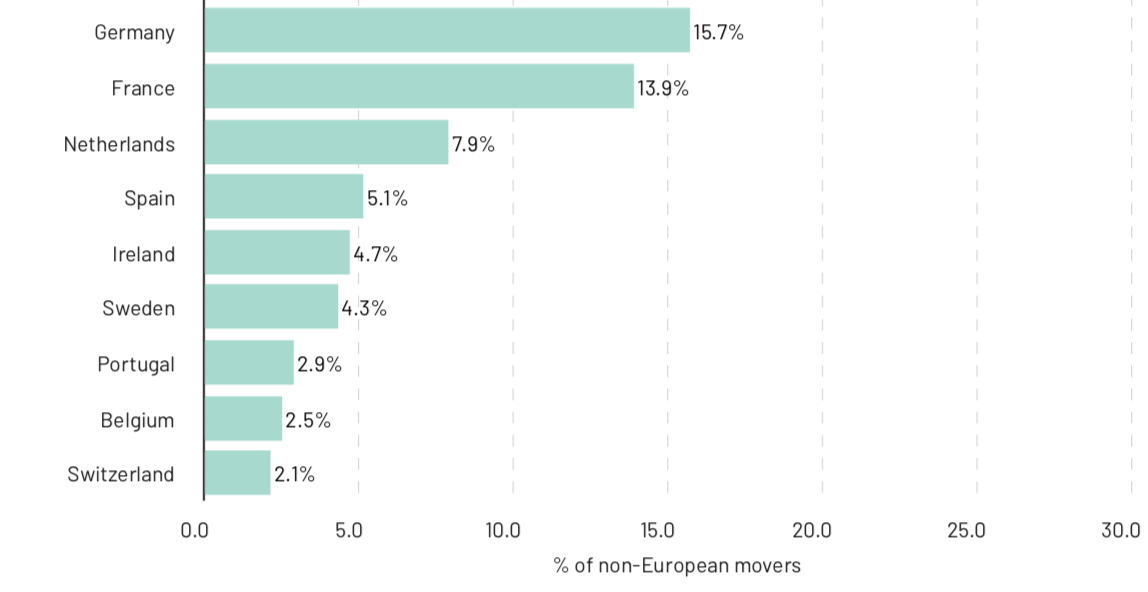

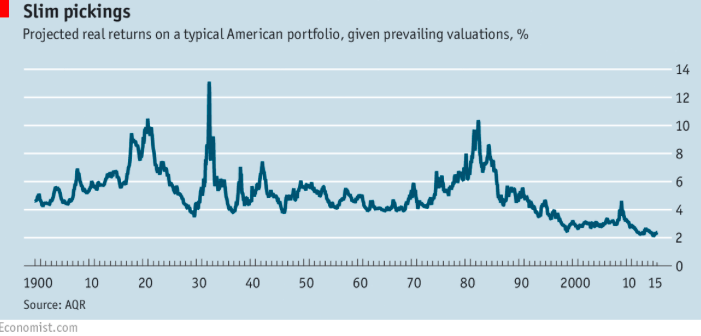

5/5/2021 The Mainstreaming of Venture Capital[THIS POST HAS THE RIGHTS TO BE REPUBLISHED ON REFRESHMIAMI.COM AND NO OTHER SYNDICATIONS] Considering #miamitechweek took the world by storm via Wired.com on Miami and even locals like Austen Bunsen who played along, and went with the flow what is going down in venture capital is something humanity has never seen before. Humans globally have been cooped up for over a year, builders building, and everyone is all of a sudden super familiar with transportation law and clear on what government agency would give them life saving vaccines if needed. The words “domicile” get thrown around a lot just as much as the word “startup” these days. People forget SharkTank the original OG VCs has been on air now over twelve years, that’s more than a decade prior to even Netflix becoming mainstream. When SharkTank aired, Uber was a prototype. Venture capital isn’t a new asset class it’s the natural evolution of consumers and investors “wanting a cut.” This consumer demand surge is putting pressure in a lot of places: for venture as an asset class as a whole, consumers participation into product development (for profit or simply activation), and a huge flip of consumer behaviors post global pandemic. What’s going to happen? More money into venture, more people having equity stakes in the outcome, more interested and caring consumers especially for new or emerging products. Just ask the banks. CONSUMER DEMAND FOR VENTURE As consumers are feeling disappointed by public markets as a whole, banks themselves are reporting increase for demands for alternative investment products, notably the areas which venture capital lives or pre-public stock. Consumers have grown tired of public stocks being late in the market, so much so that overall expectations of public market returns are mainly low which is not always a good thing, as it makes public stocks an asset class less attractive. Or alternatively makes venture capital more appealing. The lack of attraction of public stocks as they exist today has pushed for products like SPACs, which have been around since the 1990s and have made a comeback as a way to give the average Joe or Jane a seat at the investor table, “…consumers are always looking for outlets for getting better returns without the constraints of a traditional investment advisor--where extra fees are paid.” Jonathan Carvalho Pruna, a New York based banking analyst went on further “SPACs have been a recent way for consumers to make a hefty return without feeling like they’ve paid too much in fees. Which is always, of course, appealing.” This push onto from consumers to banks for better investing tools is confusing at best, since there is both the demand for digital currencies as well as tools for investing into startups and companies directly. Consumers are also no longer complacent with the returns of their 401ks (and its restrictions), real estate (and its restrictions) or public stocks (and its restrictions) and lack of exposure to startup equity (accredited investor status restrictions which limit consumers) and in many cases without being a direct employee with access to startup equity, there's not many options for the average person to access venture capital, there's further examples where its important to offer equity to people like with the recent Basecamp debacle where politics came up at work and long story short 1/3 the staff resigned. If employees or consumers don’t have a “cut” there is no having it. When the internet tried to save Gamestop stock from imploding, consumers were left with bruises and questions even when organized in mass and on platforms like, Robinhood. If consumers want a financial stake enough to sway corporate decisions, what does that look like and are public stock offerings the best tool to consumer investing anymore? Venture and real estate, sometimes both. Compass went public to rave reviews as well as Coinbase’s IPO, yet the investors from the earliest days are whom would benefit most from this public offering, not the public, initially anyhow. Trends within public stocks start to blur within private equity and consumers wonder how to get into deals earlier. And so there is growth even on the private side looking towards... private investing. DEMAND FOR INVESTING INTO PRIVATE ALL TIME HIGH ENTER ROBINHOOD, DIGITAL COINS, BTC, ANYTHING ON THE INTERNET… A decade ago consumer startups struggled to get mainstream adoption and corporations were weary to sign on “risky” startups, whereas now most major corporations especially retailers have their own corporate venture capital arms. Not as fun or flexible as traditional venture capital funds yet it’s a start. Consumers have proven they want and crave to be part of the product experience. It’s a change in consumer behavior exacerbated by consumer boredom from a pandemic limiting activities and consumers and from this, savings. Conservative estimations place consumers as having saved up over $12.5 Trillion in spending power for 2020, with consumer consumption not expected to “normalize” until 2023 which means all things consumer will only grow in volume and verticals. PIMCO and other large institutions manage at times $3 Trillion on hand, this means that there is a lot of consumer cash-power awaiting to pour into venture capital. It is only inevitable but how to scale it? What do investors think of venture capital? Since data supports there are more privately traded companies (not listed) than U.S public listings, and when the math is really honed-in terms of company value creation, most of that creation is done pre-IPO. Why would one want to invest into a product that has lower returns, less options, and generates least % of company value creation? But interestingly enough venture capital isn’t becoming just mainstream, its spreading into regions which typically have vary different consumers behaviors which show, overall American consumer support for venture backed or new startups will continue to grow steadily: In reaction to consumer-focused companies (beverages, foods, household) consumer changes are off the charts changing verticals and price points, but one thing is certain consumers like having a say. [Beverages: I don’t know what you’re doing but I’m getting 5 pitches a week and I don’t even direct invest?] VENTURE CAPITAL USE... UP. CONSUMER SPENDING...UP The other interesting correlation is the myth that venture capital is somehow not invested or interested back into "the people" the data indicates otherwise: the more profits, exits and market mobility the more capital is re-cycled or poured back into capital. This is likely based upon holistic and tax planning; if profits are deferred many times the taxes can be as well. What ends up happening is more private money floods the market than government money could try, especially with its bureaucracy. Many industry experts forget to highlight this: one of the best nations in this world, Sweden, also has the most % of GDP invested into venture capital. Think about that, can we be Sweden while also LESS capitalistic? I'm not so sure. But if you take bank data and private data, consumers are spending more and more money is coming into venture capital than ever: MARKET REACTIONS TO VENTURE DEMAND, DIVERSITY IS INEVITABLE The traditional financial markets response to this increased venture demand is with Fund-of-Funds, of venture capital funds developing smaller models for more spread for spreading investment across multiple venture capital funds especially smaller ones, particularly as pension funds evolve and start lowering their minimal threshold investments. In human speak: pensions are getting more comfortable investing smaller check sizes into venture capital but still need risk spread. The result of this are new “nano FOFs” as middle road products for giving access to pensions in a faster way than the traditionally long diligence process. VC FOF Cedana Capital announce their new “Nano-fund” essentially a smaller more nimble fund-of-funds for smaller sized venture capital funds particularly those under $15MM in size reinforcing the market need and in a newsworthy example, Ohio Third Frontier invested $13.5MM spread across an angel investing program, hospital program and venture fund Lightship Capital, a black-owned and female operated venture capital fund disruptor funding minority led startups like Healthy Roots Dolls (who sold out from Target like hotcakes) from areas all over the Midwest and south, previously overlooked regions in venture capital; in regards to venture funds adapting to consumer needs comments, Candice Matthews Brackeen of Lightship Capital (which takes cold pitches… startups!) said “there’s plenty of work to do on all sides” referring to consumer innovation and retail participation to help meet the growing and new demands of consumers. Increased market demands for venture capital funds and funded product creates larger opportunities where there were none before: Harlem Capital known for its power lists of emerging venture capitalists closed its Fund II oversubscribed with $134MMin parallel to MaC Ventures $110MM Fund I close, nearly a week apart. Some funds have created packs for deploying capital faster to underserved managers like with Alpaca VCs $2.5MM Diversity initiativeor First Close Partners. Opening up access routes to smaller venture capital funds is crucial to rolling out diverse products that people want, First Close Partners is said to have a focus that “backs venture funds owned by underrepresented managers”with the caveat of helping these emerging managers “get to first close.” DEMOCRATIZATION OF VENTURE CAPITAL, ROOM FOR GROWTH

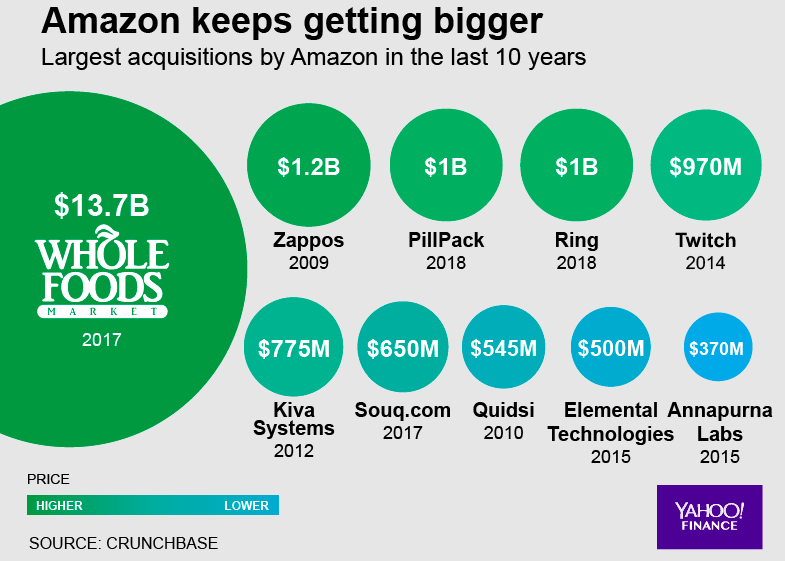

According to most reports its still tricky for female managers to get their hands onto capital at the same rates as men, and are scrutinized more over “traction” than male colleagues but this out-of-date mindset will eventually be flushed out due to all the new founders and managers entering venture from all regions and backgrounds. For example, current DocSend data indicates that potential investors spent 50% more time scrutinizing traction for femalesraising money compared to male cohorts reviewed. Venture capital has the estimated activity of over $125BN each quarter and perhaps up to has $1 Trillion private activity a year. Room for growth in all directions so current bias within fundraising will quickly adjust for the influx of new talent coming into venture capital. Traditional methods often criticized as discriminatory, have been skipped with some funds raising capital online using platforms like Republic. One online fundraising success story is Arlan Hamilton of Backstage Capital who raised $4.85MM on Republic across thousands of investors—but what is overlooked is Backstage powered a whole new set of 7,000 consumers they can message and leverage. New alternatives for fund managers themselves pop up daily and these platforms along with Angellist Syndicates is only the beginning, they change weekly. (I do not support using Angellist syndicates as a product and as a Fund-of-Funds manager) On the Florida front, the Mayor of Miami seems to be gearing up for the drove of thousands of new residents and people excited about entrepreneurship. Some buildings in parts of Miami are reporting hundreds of new tenants in the last few months, most from the tech and venture industries. Emerge estimates over $2.27BN in transactions happen in the Miamiarea annually and growing so with the new energy coming into the city with a Mayor who has opened arms from other cities (known for “How Can I Help?”) Miami is set to be an interesting playground and startup hub in the coming years building off decades of startup ecosystem already in the mix. As more capital flows into venture and more people interested in the space, and a pandemic slowly lifting there is set combination of builders (and consumers) ready for massive innovation. Contrary to some online narratives, the growth of venture capital is actually the process of making it more democratic. In a world where consumers actually have MORE say, what could go wrong? [PS- Miami people we are having a flashmob Sunday May 9that 12:00pm in Midtown, locals are meeting at 11am Tap42. Be there or be square] [Might delete later] ABOUT ME: Friendly asset manager based in Miami, Florida. I love venture capital, startups and pretty much anything consumer @ecachette on Twitter I take cold pitches 12/8/2020 The Future of Retail is StartupsBy 2009 most large corporate retailers knew they had a problem on their hands: Amazon. While retailers were trying to figure out how to compete, Amazon went on a spending spree buying Zappos for $900MM USD and a half dozen other ecommerce “startups” in a way that not only let it prepare for a series of battles but prepare to win the war. Eventually retailers were onto their core problem with decreasing revenues: consumers were touching and testing products in their retail stores but purchasing online, sometimes even using their mobile phone while standing in a retailer store. We know because all that free in-store wifi could track not only consumers online behavior, but what they were doing offline in the store as well. The tricky part for saving retail from a guaranteed implosion around 2021 would be coming up with a plan within the next 2-3 years from 2009. Giving 2-3 years to test, 2-3 years to roll out quickly across all stores whatever solution that might be. It sounds crazy to think a decade isn’t enough time to produce massive change yet for large corporations its like making a U turn on a narrow cliff. Facebook saw the future of ecommerce by buying Instagram as a moat and WhatsApp as its cross-channel. Amazon did its own prep, making sure it owned Zappos, Ring and Audible all before 2013. Not only could Amazon track your order, it could control the words you listen to and assist your doorstop with a camera to ensure package security, at the consumers cost. This small step is genius in itself-- Amazon took the problem of missing packages and sold the solution back to consumers. The retail heat really kicked up in 2014 when most internal corporate ideas were working at traditional retailers and consumer behavior was changing even faster than data collection could happen. Social media was not going anywhere and costing more for internal marketing; sub brand ecommerce websites growing faster than ever disrupting retail distribution value and consumers too were easily sharing clothing online like with TheRealReal, or temporarily rent a normally very expensive dress with Rent The Runway for just a one-time fee or even test beauty products monthly like with Birchbox. If no major retailer could find “the ultimate solution” to the guaranteed retail apocalypse and have it in place by 2017 survival rates would look slim. Increasing real estate costs mixed with higher consumer foot-traffic (and those costs) than ever, additional capital for online ecommerce marketing, less items being bought in store (sales down), SEO getting more competitive online (online cost increase), and then sometime between 2017/2018 the CAC or Customer Acquisition Cost for traditional retailers was flipped on its head by successful DTC or direct-to-consumer startups jumping into commerce with little startup costs and max revenue is selling products directly online to consumers, which was inevitable. Now all of a sudden the monopoly that big retailers like Wal-Mart, Macy’s, Sears, Target etc had on brands is no longer relevant. Startups were taking money from retailers and brands were learning how much retailers were “taking” by simply offering products in physical stores. The margins that retailers were taking from brands for simple distribution, were being cut out and given back to brands or consumers in product savings. Online ecommerce was no longer a fad like a Twitter campaign, entire companies like Warby Parker, Harry’s, M.M LaFleur, Casper etc were now coming into retail with superior products at reasonable prices and sold direct to consumers without even so much as a physical store. Tesla was around too booming with its own electric car sales despite not having many places to test drive a car, and some states like Texas still not okay with that. Startups have been proving for sometime that retail stores no longer have the same purpose-- a physical store location was no longer required for a consumer purchase. Since startups could not afford retail space or the chance at lost dollars in person, they HAD to rely almost entirely first with online sales then secondary with corporate partnerships (ex: American Airlines pilot programmed Casper blankets on its airplanes) cutting out the retail middleman altogether. Tesla was around too booming with its own electric car sales despite not having many places to test drive a car, and some states like Texas still not okay with that. Startups have been proving for sometime that retail stores no longer have the same purpose, and a physical location was unnecessary for a consumer purchase. Since startups could not afford retail space or the chance at lost dollars in person, they HAD to rely almost entirely first with online sales then secondary with corporate partnerships (ex: American Airlines pilot programmed Casper blankets on its airplanes) cutting out the retail middleman altogether. STARTUPS ARE BETTER AT ONLINE COMMERCESuperior Online Marketing Social media caught all retailers off guard and thus much of internal marketing resources were concentrated on online ads and online areas which are now redundant. Whereas startups, who had to learn the leanest way for the most consumer purchases (no clicks) hacked their own routes to their consumer base at nearly a fraction of any cost it would take the same retailer to reach the same consumers. Startups de facto living and breathing online are already their own marketing department even if they only currently have a few products. Further, some startuppy products like Twiliohave become crucial to online deliveries or text confirmations. Faster Product Innovation Smaller teams for decision making, smaller product batches, smaller everything means that startups can change and adapt products in a way that a retailer never could. Startups are agile, aggressive with getting consumer feedback and can even test for consumer sentiment before producing a single thing. If consumers have become more demanding on production, startups are the solution. I remember working on Pilot Programs in 2009, 2013, 2016 for retailers trying to figure out how the new integration worked between retailers and startups. Some of those retailers have figured it out, like how a Swedish startup took $670,000 in investment money and turned it into $2.2MM annual sales, then rolled itself into a major partnership with H and M. Other retailers like Target have certain shelf space set aside for startups like Harry’s etc, exploring a startup “pop up” within their own stores. These collaborations are more reflective of the retailers themself. One might argue other retailers are still relishing in the past, overpaying for 10 year apparel deals for the sake of short-term stock lift when there are thousands of online influencers driving much more in new sales to companies at lower $ rates, thus higher ROI (return on investment). Startups Are Lean and Efficient Once a company’s headcount surpasses even 1,000 it can become impossible to make company-wide decisions quickly. Many startups hit this “stall rate” even around Series B, since scaling requires capital and resources. By default, any innovative solutions for retail will surface as startups… so retailers quickly become startup friendly or startup allergic. The translation of this exacerbates the importance of time, HOW quickly can change be implemented. STARTUPS ARE THE FUTURE OF RETAIL STOREFRONTSThere is Currently a Surplus of Retail Space Retail property owners have long thought about creative ways to use their spaces and since 2012 entrepreneurs have been trying to figure out how to hack the retail space without being obligated to it and startups are not afraid to co-work together so when you add these cultural advantages with the mix of excellent online marketing you get the perfect storm awaiting all the empty, Covid-19 driven vacated store space. Retailers were struggling to keep the machine running prior to DTC startups or a pandemic forcing people to stay home. The only hero with a cape here will be startups doing their own pop-ups in existing retail spaces at the fraction of operational cost. Startups Know How to Test Consumers Retailers are constantly paying big bucks for “data” to understand consumers when the proof might be more in shopping experience itself and what consumers want and need: wifi, an experience to remember, and a connection to a product or products. Startup Perch Interactive works with large retailers for in-store “engagement” which could also be applied for future startup pop ups. Meanwhile, we see brands buying hardware startups like lululemon did with Mirror likely to innovate its own stores and colleges designing new robots to assist retail— what’s exciting about all this innovation being built withstartups are leading the way. The Power of Data Startups know how to max the data they learn from small groups (they call it beta testing) to learn and interact to become even BETTER at innovation. There are now startups focusing on shipping, labeling, selling, seeking, reducing waste, reducing time and nearly all areas of efficiently that need to be built out to accommodate how drastically consumer behavior is changing as related to retail. I even know startups focusing ONLY on how to optimize shipping out using existing carriers like UPS already, shortening delivery paths and thus time, gas, and materials. Retail Stores As the New Town Centres While it is hard to say for certain the future of community in a post-Covid world, everyone knows it will look completely different from a shopping perspective. In one secret corporate interview, the retailer asked me what their stores (known mostly for home items) would look like if they pivoted into a healthcare company, meanwhile Wal-Mart has thought about turning their parking lots into theatres, and a popular Canadian grocer became its own farm. The retailers are still testing, while Amazon bough Whole Foods in 2017 steps and years ahead. AMAZON WILL WIN ANYWAYDespite all the efforts, whether it’s the startups hustling to be acquired by a retailer or acquired by Amazon directly the most successful startups are likely to find corporate homes within Amazon. For the large retailers, who with certainly will be forced to reduce their workforce nearly 70% to accommodate the changes in their business models, even if they work or acquire enough startups to bring them back to 2017 profit numbers, retailers best outcomes will be getting acquired by Amazon and converting their stores into new localized amazon hubs. The only choice it seems is if retailers control their acquisition or not. Amazon has already begun to construct how to turn deserted malls into distribution centers and while they claim its merely for distribution who is not to say these malls may end up being full of startup pop up centers? Amazon has also already been vetting and meeting with startups, its only a matter of time before distribution isn’t just boxes its products and people. One way to tell this is an ecosystem that is surely to continue building out is that financiers like ING are even offering financing to startups working with Amazon so the layers of support, even financial build around. Right now it’s the holidays, a pandemic, and stores are closing and changing. This holiday shopping season is certainly not acting the same as in the past and some retailers do not understand the depth to which they are stuck, so once the dust settles startups will be able to give new life to both retail shopping and consumer behavior in an experience that is likely to be more beneficial to consumers either way. ====================================== CITATIONSAmazon Buys Zappos, NY Times (2009)

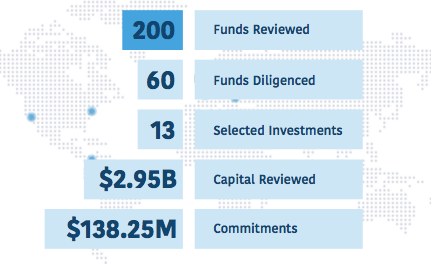

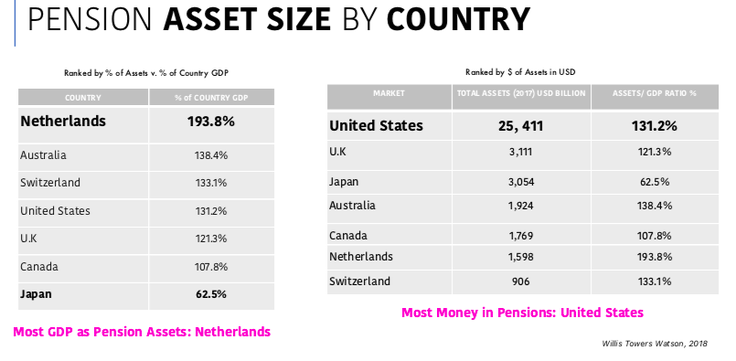

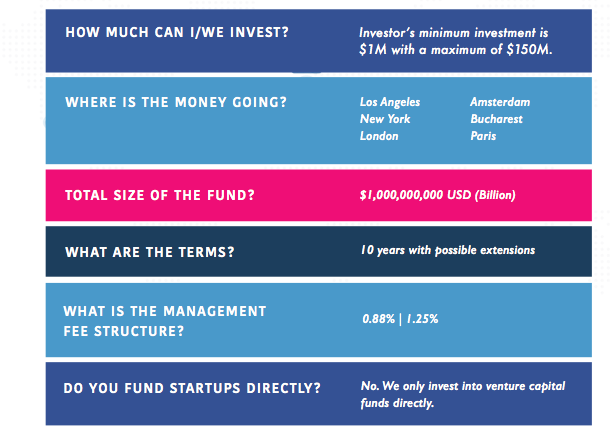

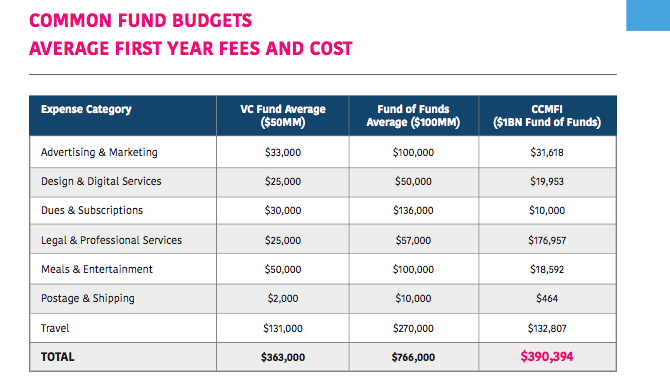

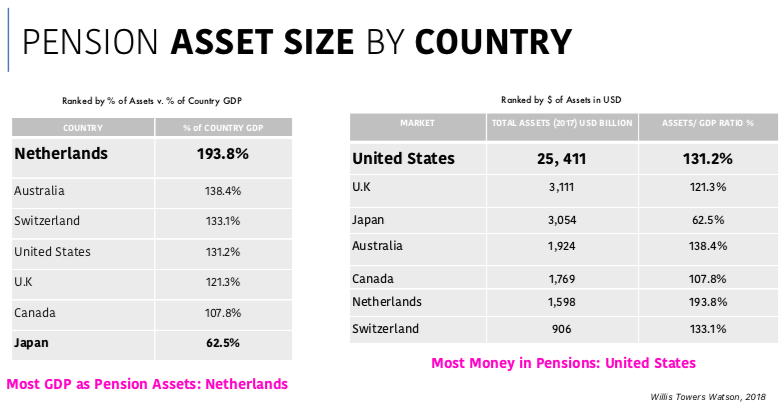

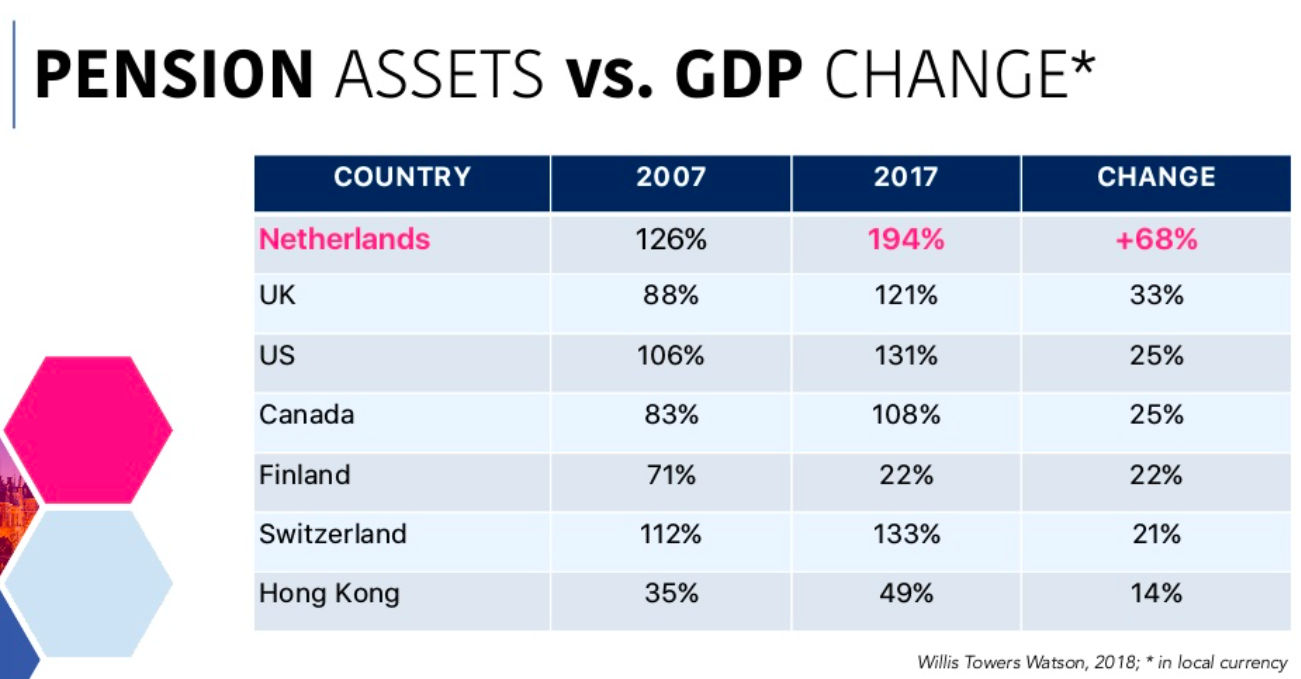

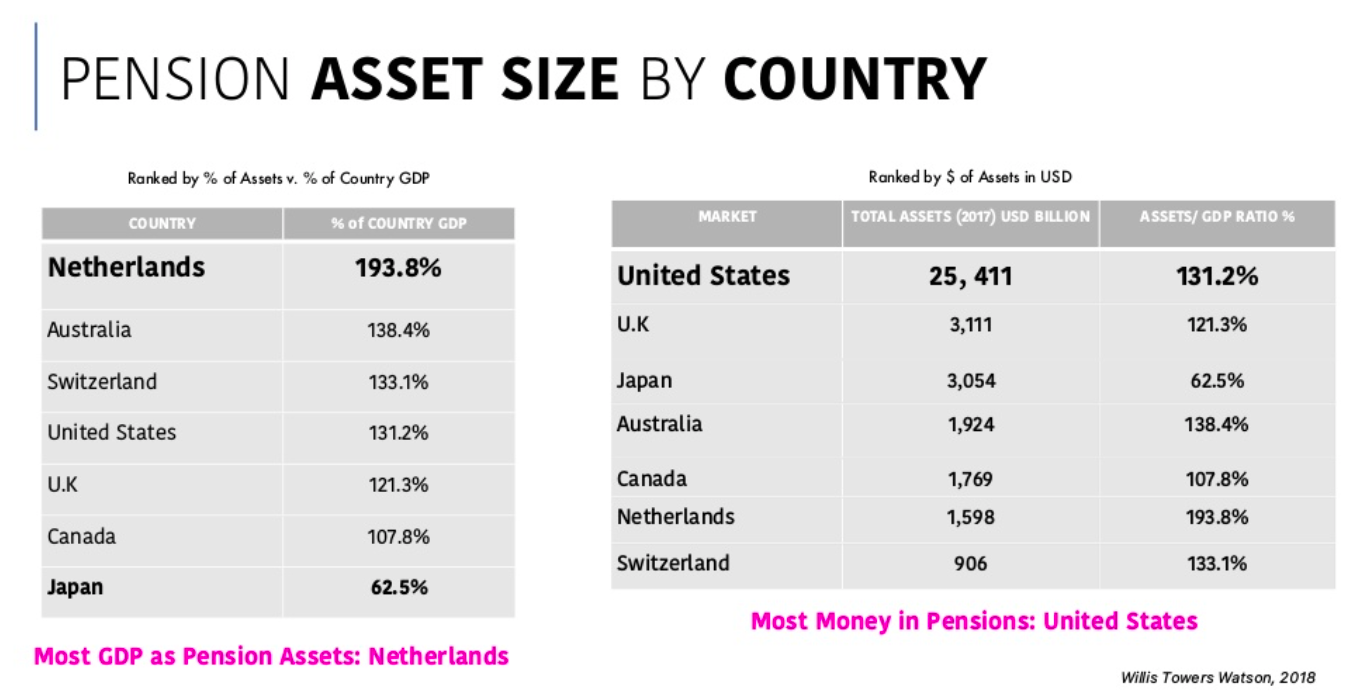

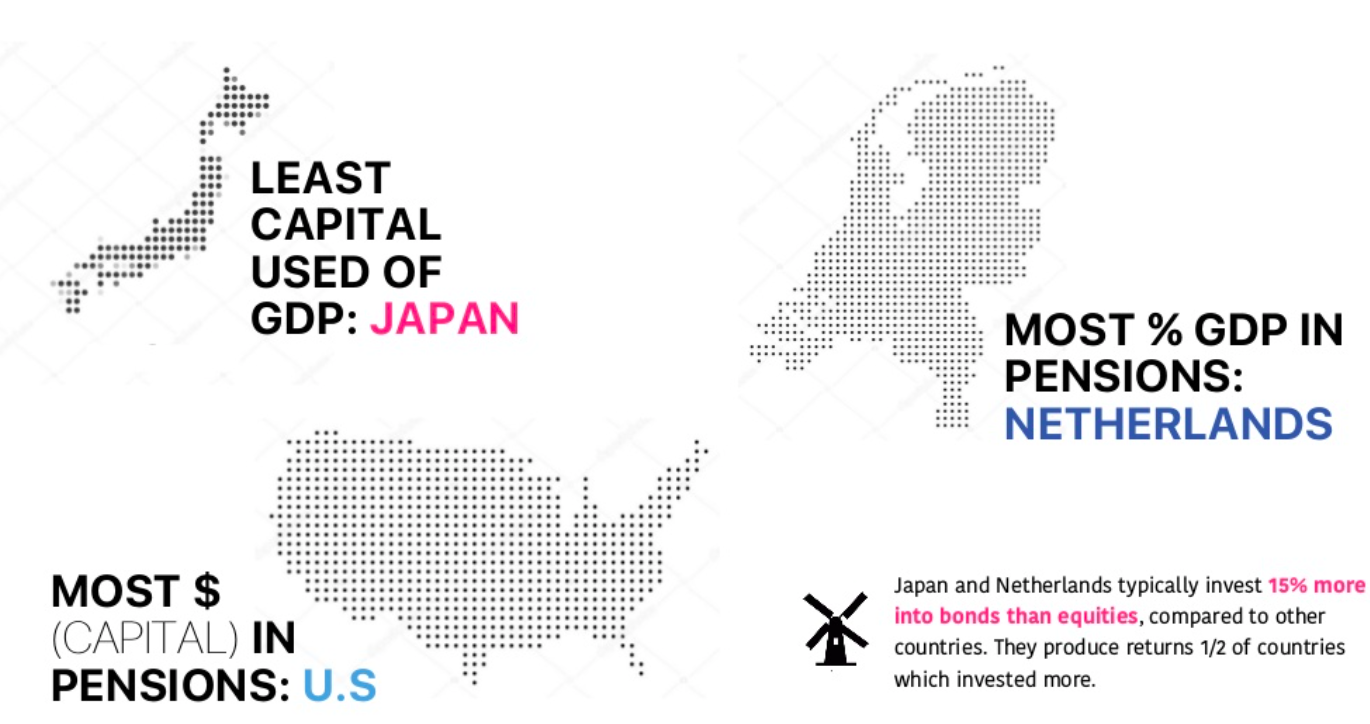

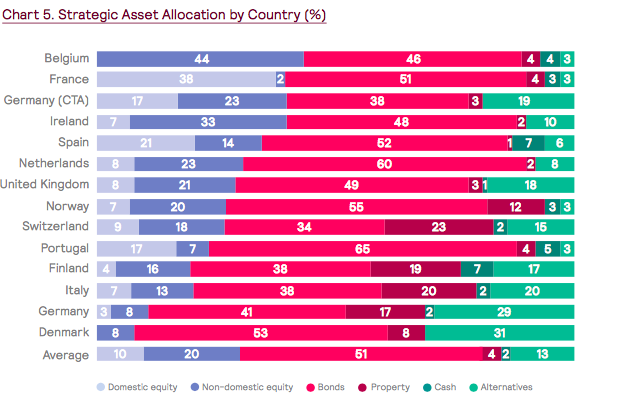

https://www.nytimes.com/2009/07/23/technology/companies/23amazon.html Facebook Owns four most downloaded apps, BBC News (2019) https://www.bbc.com/news/technology-50838013 Amazon to Buy Audible, Reuters (2012) https://www.reuters.com/article/us-audible-amazon/amazon-to-buy-audible-for-300-million-idUSN3129158120080131 CBinsights Future of Retail Technology Startups (2020) https://www.cbinsights.com/research/report/retail-technology-startups/ Telsa CEO moves to Texas, CNBC (2020) https://www.cnbc.com/2020/12/02/tesla-ceo-elon-musk-plans-to-move-to-texas-friends-and-associates-say.html American Airlines Partners with Casper, Techcrunch (2017) https://techcrunch.com/2017/09/28/american-airlines-teams-up-with-casper-to-offer-new-in-flight-sleep-products/ Swedish Startup Small Funding, Nordic9 (2019) https://nordic9.com/news/chimi-eyewear-secured-capital-for-an-eyeglasses-online-operation-news7963784599/ Swedish Eyewear Brand Partners with H and M, vogue (2020) https://www.vogue.com/article/chimi-swedish-eyewear-brand-opens-flagship-collaborates-with-h-and-m GAP Signs Kanye West, BusinessInsider (2020) https://markets.businessinsider.com/news/stocks/gap-stock-surges-10-year-apparel-deal-kanye-west-yeezy-2020-6-1029346081 Landlord Retail Store Creativity (2019) https://stratafolio.com/creative-ways-landlords-are-filling-vacant-retail-space/ Sears and Kmart Closing Stores (2020) https://www.forbes.com/sites/warrenshoulberg/2020/07/12/total-sears-and-kmart-store-count-going-down-to-just-95/?sh=5020c2d60eb5 Lululemon Buys Hardware Startup Mirror, NY Times (2020) https://www.nytimes.com/2020/06/29/business/lululemon-buys-mirror.html MIT Making Retail Robots (2020) https://www.cnn.com/2020/07/04/tech/mit-csail-coronavirus-robot-scn-trnd/index.html Wal-Mart Considers Parking Lots As Theatres, CNN (2020) https://edition.cnn.com/2020/07/02/business/walmart-drive-in-theaters/index.html Canadian Store Becomes Its Own Farm (2020) https://returntonow.net/2020/06/18/canadian-grocery-store-grows-its-own-organic-veggies-on-rooftop/ Amazon Turning Malls Into Distribution, BusinessInsider (2020) https://www.businessinsider.com/amazon-looks-to-turn-malls-into-giant-fulfillment-centers-report-2020-8 Amazon Fund Meets with Startups, Wall Street Journal (2020) https://www.wsj.com/articles/amazon-tech-startup-echo-bezos-alexa-investment-fund-11595520249 ING Offers Loans to Companies Working with Amazon, FinExtra (2019) https://www.finextra.com/pressarticle/83130/ing-germany-to-offer-business-loans-to-smes-trading-on-amazon 10/17/2020 The CCM UNFUNDFor every investor win, there is the one that got away or the anti-portfolio. That’s the companies that become publicly traded and when you had a chance to invest $10k in their angel round in 2012 or the startup you mentored and almost got a board seat on before your nemesis woo’d the founder away at the last minute. You think about it when you see the founder on TV or a family member buys you Earth-moo socks and you burst into tears “I could have gotten in PRE SEED!!!” Most successful investors always have a thing or two which becomes a big hit but somehow slipped away, for me, my anti-porfolio is myself and original batch of CCMFI VC investments. For me, the one that could have been, the one that got away, are the beautiful 2017 VC vintages CCMFI planned for that we had to change, modify, exchange, withdraw, whatever due to varying delays many of our Batch #1 VC selections. R.I.P Batch #1 I will always love you VC vintage 2017/2018. CCM Batch #1 (Planned 2018)ORIGINAL FUND DESIGN AND TIMELINES CCMFI founded from the earliest days a pension friendly fund-of-funds structure. Research began in August 2016 and by luck I came in contact with the Dutch government (in New York) who thought the fund-of-funds concept was clever for helping public funds make profits and be part of venture capital, which at the time would also be a publicity bonus for Netherlands as people were getting annoyed by slow innovation and flat returns on mandatory pensions. By March 2017 I was offered the idea of launching my new and upcoming fund FROM Netherlands as a win-win: I could save on setup costs, be near European pensions and Netherlands could get copies of my fund notes and learn from a Silicon Valley expert. Fair enough. I checked the market numbers and while similar to NYC market Europe had a massive amount of pension capital sitting in reserves with potential for growth so there was enough capital to indicate the venture capital market could reach 100BN annually. If you looked at the capital available to do so if even 1% of pension monies were allocated to venture capital, Netherlands could deploy $150BN assuming there was enough places for it to go (?). While a tiny country in size, Netherlands is a serious global contender for capital reserves. See above. Looking at the venture capital numbers themselves, Europe was still emerging at CCMFI’s onset and showed itself on a trajectory towards $50BN+ annually. In 2017 EU venture capital appeared to be growing at a faster pace than NYC venture capital crossing over $25BN. See also The $50BN Elephant for a more detailed analysis. After a few rounds of in person meetings with Netherlands on Third Avenue, including with my Board, I made the decision (albeit) quickly that I’d move to Netherlands and build my first-time fund from there. How my super early American LPs were okay with this I will never understand, I think everyone was curious how this would play out. Here is the letter they would later give me which would kickstart living and working in Netherlands. I was excited about it too it seemed Netherlands was loaded with potential. Note: If one of my fund managers lived in my hometown and said they were moving to a village in France where they knew not a single soul to launch a fund… I am not so sure if I am that brave. Not all heroes wear capes, Howard. CCMFI FUND TIMELINESMy original timelines with built in buffer for CCMFI had beta (American) LPs entering it May 2018 with pension enrollment around at the earliest 2019 (24-26 mos from april 2017), full close in 2020/2021.Like all funds, the more in placement I had the more I could capital call. I knew a 1BN fund would take time both oboarding LPs and executing safe investment deployments. The thinking, especially for pensions, was that the fund could operate and fund as quickly as possible while growing and maturing its product. CCMFI FUND SPECSFrom the beginning of CCMFI there were fail-proofs or back up to backups to backups, which I would eventually have to tap into much to my amazement. All asset risk modeling I ran ended gave a minimum $1BN fund size and I was already getting feedback and documents from pensions saying diligence could take up to thirty (30) months and since there were multiple Dutch pensions with $100MM+ minimums and they could not individually be more than 20% of the fund, and collectively public pensions could not be more than 30% of my investor base, any FOF under $700MM in size simply would be too small. Fund Size: $1,000,000,000 USD Pension Timing: I figured this whole process would take 24-36 months from April 2017 a la pension friendly FOF deploying and calling pension capital as early as May 2019 and late as May 2021. I was also a first-time fund manager, a female, and with a thick American accent. I moved to Europe ready to GRIND not to be Emily in Paris. Investment Period: Since the fund started investing into VC funds in early 2018; with a three year investing window listed in the funds terms, this also meant any pension or LP delays could be met with one small extension with a small group LPs if needed. Short term this would be low on collecting income or management fees— long term useful to the fund’s integrity. At every fork in the road of this process I always opted for higher quality than quick or useless KPIs. In this way CCMFI is still within its original planned investment window until June 2021 assuming no extensions. Investments: Since commitments and capital calls are different timing altogether and each fund on its own schedule, the math between the GP and early adopters was tight so we figured out a way to keep certain VC slots or for no charge let cofunds or investors fill when appropriate. In advance I knew that patching fast-paced FOMO VC funds with incredibly slow turtle-power Pensions would be a challenge, so I came up with varying scenarios and would Side Letter or make different timelines for various VC funds. Shuffling time with venture capital funds was not too hard since often I was the lead or anchor and some emerging funds still had to finish raising their funds which can take a normal 1-2 years BUT the 2017/2018 vintage so lit even pulling in long standing favors there’s only so much time I would be able to buy on either side so the hard part would be filtering through hundreds of venture funds to find ones which could fit all of CCMFIs criteria and expediting and prioritizing them as fast as possible. Our Fund Strategy is online here over 1,600 people have found it so thats good. Investment Diligence: The hotter the funds I got into, the hotter my fund and there’s only so much FOMO pensions will eat they are not the normal LP who can be quickly coerced into a bowl of “fund is totally closing this week.” However I could do my best. See also Managing Venture Capital Relationships. We established hundreds of pages of documentation for our IVG group (VC investment review) sharing it all with Dutch pensions along the way. Everything from risk analysis to common foundation questions. I’ll email anyone a copy of our 2019 IVG group framework which is used by several of our co LPs if you send me a note. I can run the whole thing on one VC fund in a less than an hour if I do it myself, otherwise if followed it could take an junior analyst a few days / week to use to screen a VC fund. CCMFI INVESTMENT GROUPCCMFI Investment Group policies and diligence procedures (on VC Funds) - 36 pages Want a copy of our 2019 IVG Documentation? Send me an email Low operating costs: Since pensions would be involved cost was always a factor. After review of legal, admin, operating costs I estimated that setting up a $200MM FOF would be about the same setup cost as a $1BN fund. CCMs budget for the fund setup estimated around $300,000 and the budget for the management company set arbitrarily to $700,000 (per year, and with no salary for myself). While LPs share Fund costs we knew early on the management company would take a few years to be profitable, which is normal for any new business. A new management company was in its earliest days and a new fund needed to be made for it. Since the whole idea of CCM is easy access for pensions, we also wanted to make sure costs were as low as possible and processes streamlined. From the data I have, I know that we built CCMFI for about the same costs as if a $100MM fund was setup and less in fees if managed in-house my someone. See also Managing Venture Capital In-House for other costs. Often CCMFI would / prefers to commit earlier to a VC to save on fees, any fees saved passed directly to pensions. CCMFI Fund costs are the far RIGHT column below: OUR INVESTOR REQUIREMENTSBuilding a fund that gives preference to pensions is no easy feat. Armed with a general manifesto for venture capital investing and penchant for pensions (see also, The People’s Money) there were additional considerations about who could be an LP and how many which all had to be planned out in ADVANCE to the fund’s various documents and rules being made like LPA. On the surface the main components for LP demographics worked as such:

NETHERLANDS SO NETHERLANDSWith a fund roadmap in hand, I began building my first fund in a faraway land, living mostly off the caffeine of free office coffee and Stroopwaffels. First CCMFI beta LPs came in May 2018 as scheduled and I REALLY knew by February 2019 that a June 2019 (earliest entry date for pensions) would not work since we were still awaiting approvals on various documents from that were submitted the winter before looking to be approved but pending. The corporate LPs were behind the pensions with DDQs falling behind. Without much choice I had to start changing many VC positions in 2019 and changing a super-well-thought-out-plan for investments and LPs to allow other funds to move forward at a faster pace because I could not reduce the quality of the fund. See also You Cannot F**king Ship a fund. I kept trying to convey the urgency in Europe realizing CCMFI needed to be ramped up for a fall 2019 pension onboarding to assume it would take some months, yet everyone was getting ready for European "holidays" while the American VC funds and startups were building (like all thru every night Europe slept) and their valuations were skyrocketing quickly as they should. Since this growth pattern doesn't exist often in Europe its hard to explain to someone who hasn't seen it themselves. I will always love you VC vintage 2017/2018!! (Batch #1) Planning to move around VC positions is stressful and some funds I had found in the deepest corners of the earth or competitively gotten in --I would find many VC funds new LPs to swap CCMFI out. Sometimes you gotta do what you gotta do and I’m lucky to have gotten into that vintage at all, but never again will I do so much work “for free” and I mean that towards pensions too. There's hundreds of venture capital funds in the world but Batch #1 is still the one that got away. That combo. That timing. Those market conditions. Those exact startups, sigh. Another strange thing in Netherlands was that after successfully passing a fairly large EU diligence packet—some bad actors started to pop up, Dutch vendors began to overbill the management company, the Dutch government “coincidentally” entered me into an audit immediately after and withheld the renewal of my residence permit until the audit was done with a reminder that if I left Europe I would not be allowed back, and— It felt like everyone knew my fund was moving forward and wanted a “cut” even though I was only halfway there and a few million deep in expenses (already) and no paycheck (yet). IF YOU SAY THE WORD ROI ENOUGH TIMES...Other quirky things had popped up, I remember being covered in shingles once from stress, while in hour 34 of a 100hr pension compliance packet (DDQ in Dutch) and walking by the office lobby to see a Dutch prince talking to a startup about how to get app users with “ROI” sewn into his jacket; meanwhile I couldn’t find a single person in the building who either knew Dutch well enough or knew venture capital well enough to help me with various forms. I promised myself and the government of Netherlands two years minimum and I am generally a person of my word, but every single DAY after two years passed (formally July 2019) I kept asking myself: why was I trying to do this fund from Netherlands... if another European country be any better... and what was I trying to prove? I might as well have been in outerspace: I felt like a female Matt Damon trying to grow potatoes on a space planet which had been beaming signals across the universe that it wanted venture capital for lightyears but really it just wanted my potato seeds and spaceship. I kept hosting several hundred person VC nights in Amsterdam and Zurich with many pop ins to Romania and aside from my former Associate, George Moroainu (who is killing it in Romania having just closed a Seed Round and recently surpassing 1.3BN Euros in sales for his startup post CCM) most the European CCM interns or employees I poured my heart and soul into training ultimately went to safer, easier jobs in academia or banking. Turns out doing Silicon-Valley-style-fast-deals from Amsterdam is actually stressful to most Europeans not a selling point. AMERICA SO AMERICAOn the flip side for every issue related to the lack of venture talent in Europe there was the issue of abundance of venture knowledge in the U.S and a stereotype that usually follows that which is white-dude-greed. I even had an American guy (former Citibank employee, so he should know better) demand more than $200,000 (for a harddrive of data stolen from my fund) paid to him tax free otherwise he would leak a bunch of information about myself and my fund in a way that would be detrimental. Not only did I not cave in but I couldn’t have anyway from Money laundering (AML) polices in place to protect our future pension LPs—as a fund every penny would be counted how could I justify such a payment which would be clearly recorded? I didn’t cave in to the demands so its no surprise what happened next. MEDIA HITPIECEThis is the cover image of the article showing mostly men hanging around and drinking with the few females in the photo being subservient or preyed upon. The article shared identical framing spending pages connecting dots from stolen data into a larger over-arching fabrication construct meant to sabotage CCMFI at exactly the right at a time when pensions were scheduled to be entering my fund. One could argue I was Tonya Harding-d, clubbed before I had even spread my wings. A couple talking points related to that article for anyone who has read it:

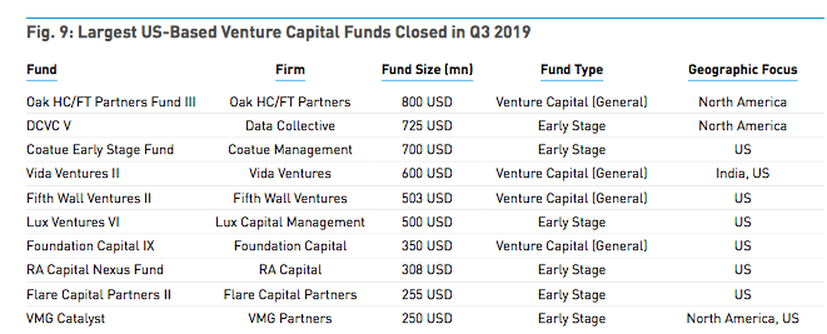

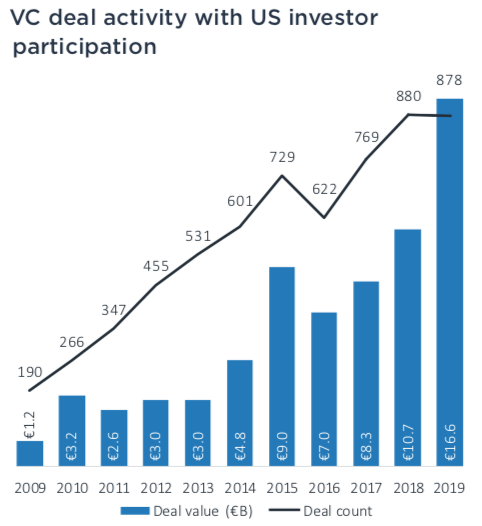

ENVIRONMENTAL CONSIDERATIONSWith or without the takedown piece which seemed to only slowly be shared around Europe, there were several environmental factors putting my fund at risk by being in Europe I started to notice more and by March 2020 when all the various country borders locked down. I had months to think about this before deciding to move back to the United States which I did this August 2020. Here are three market components I felt would make it impossible to STAY in Europe if I wanted to continue running a fund-of-funds or even stay in venture capital (aside from even Covid-19 or personal reasons): EUROPEAN GROWTH NUMBERS INACCURATE(LTV, Long Term Value, not high enough) By the time I discovered it in March 2020 it was almost too late to move back to the U.S because all country borders were closing but it was clear—most of EU venture capital was American money taking advantage of low startup valuations. The American capital which was more than 50% of Europe annual VC #s was also forcing European startups to setup American LLCs to accept the cash, so the money might have been arriving in Europe via America but it was going right back. It also explained why there was such a small startup workforce and starter founder ecosystem on the ground, particularly in Netherlands. I had a very promising Dutch kid I poured a bunch of knowledge and resources into and a year later he hadn’t absorbed most of it, one of the last times I was in the Amsterdam office he asked me if I knew what a “termsheet is” he said “you know for startups…” I run a fund based whose underlying assets are completely on capitalization tables and startup termsheets and that was the core to everything I had been teaching him #NEXT. CAPITALISM DOESN'T WORK IN EUROPE(TAM, total addressable market too small) While venture capital is an asset class and tool for empowering young and high growth companies in the private sector, its mixes well with public pension funds getting access to private profits, the base of venture capital is CAPITALISM. Fruit of thy labor. Eye for an Eye. Work hard, make money. Most of the philosophical concepts powering capitalism do not apply or wont stick in Europe. Firstly, European culture does not reward risk or entrepreneurism. Most of the wealth in Europe is from old old old money, likely linked to castles and devastating an entire village (Side note: my college dissertation in college was on inheritance within capitalist societies). Secondly, services in Europe cover most people so that they are not encouraged to think or act professionally outside of the box, everyone is well cared for. When you combine the two factors of old money and social services you end up with a very rich class of people (“Why would I invest into venture capital to become MORE RICH? I’m already rich” one EU family office once told me) who have no incentive to invest into venture capital and the concept of even wanting or desiring to become rich not common amongst the rich or those in middle or upper clasSes. In America and other countries an entrepreneur who makes their own money is respected however in Europe no one seemingly cares as everyone has their own socially protected life to live. This also seeps into business hours, work ethic, work timing and all other pieces to a puzzle needed for building “rocketships.” How can venture capital be on the rise and “exploding” in Europe if there also no whole set of founders ready to build? Venture capital is a SPORT as much as its an asset class and the love for the game the way it exists in the U.S simply does not exist elsewhere in the world #AMERICA GREED (NOT MINE)(CAC, Customer Acquisition Cost too high) As soon as my fund started ramping up traction we had issues with local greed in Europe and people’s expectations that since CCMFI was meant for pensions that somehow money could be wasted / shared. Not true. We had American and Dutch shakedowns with a couple still pending however, for the amount of effort it takes to get even 1 LP in Europe I could have gotten 4 in the U.S. Both sides have their own ways of expressing greed so I pick the one with higher ROI for the hassle. ~THE CCM UNFUND~Even in hindsight and the things which were in my control I’m not sure there is much I would have or could have changed for CCM’s launch. I think even if I had hired a European grown General Partner, there would have been slowness. I think even if I had caved in and paid off blackmail payments, only more blackmail requests would surface. And I think even if the market data for venture in Europe was more clear that it was mainly (almost entirely) overflow American capital, I still would have gone out there to check it out and see how “emerging” its emerging market is.That said, it’s a pity things could not have launched even two months sooner because I’ve had parking spots in VC funds that have been investing in startups since before 2017. Here is where CCMFI would be today had we even remotely followed our launch schedule: the fund would have launched and deployed $100MM by now, with 3x-5x in performance (and growing, some positions are known to already be performing in top percentile internationally) and over 20+ VC LP positions. Assuming LPs entered CCMFI at their projected order that would have put the first pension into the fund June 2019. While Batch #1 CCMFI funds is almost entirely different today that selected back in 2018, part of it is still my anti-fund and group of talented people I will watch from afar hoping for any chance to support them--once you bet on someone professionally its heartbreaking if your timing fails but it doesn’t change conviction. If Batch #1 had gone to schedule that would have put CCMFI as a top fund in the U.S and world. While starting up I met a half of dozen funds like mine scheduled to be $1BN or more so this size will be common. CCMFI was very forward thinking in its creative structure and ambition which I hope never goes away, despite the bruises. If CCMFI fully closed last year (not planned) it would have been top in size for Q3 2019, if CCMFI ever reaches $1BN this would be new pack of kids at school. Batch #1 going seamless would have also put CCMFI #1 for deals done since we had 13 positons allocated in September 2018. MY RISK MY EXPENSEOn a personal level and having mainly missed the projected window of my fund’s Batch #1 launch, I lost out on American income during this time for around $1MM ($250k X 4yrs = $1MM), and fund expenses paid back of $300,000, any type of income for running the fund (anywhere from $200k a year to $500k a year X 2 years = $400k - $1MM) EUROPE AND DELAYS = $1.7MM to $2.3MM lost income Personal income loss aside, I have never worked so hard in my life to get placement, move placement, help placement, build out a robust and strong backend pensions could trust and essentially doing this all from a strange place with minimum resources at hand. I certainly took some short term loses building a fund from the ground up which is normal for a GP, and the fund itself is performing well considering it all, so even if CCMFI makes up time or launches a new fund, or deploys Batch #2 to VCs quickly… whatever we do it I will never having those Batch #1 vintages and positions in that combination and no markup again. Batch #1 will always be the ones that got away, who I love from afar, my anti-portfolio, the glass stepped on at a Jewish wedding marking both that things will never be the same and never can be. I have very fond memories for my experiences living and working in Europe now that I'm back in the States. Some of those times were sweet and endearing, other parts I learned about myself and expanded in ways I didn’t think I should. But if you ask me if I still like Stroopwaffels, the answer is no. ============ ABOUT ME: Venture capitalist having worked San Francisco, New York, Bucharest, Amsterdam, and Zurich. I spent the last few year building an awesome fund-of-funds. For more follow me on Twitter @ecachette or visit elliecachette.com ~~~SOME DISCLAIMERS~~~

CITATIONS AND BACKLINKSIMAGES

LINKS AND RESOURCES

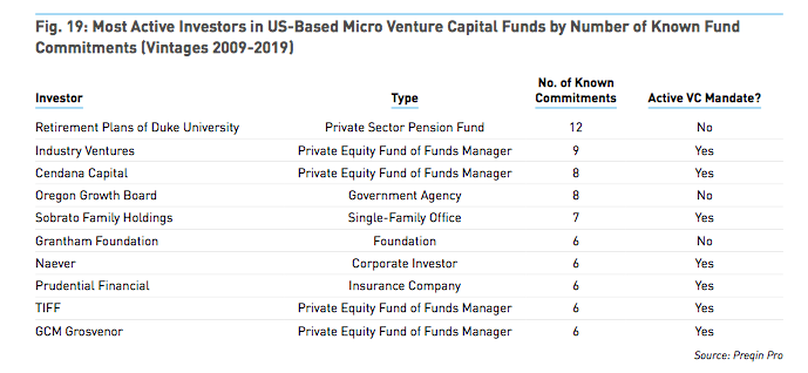

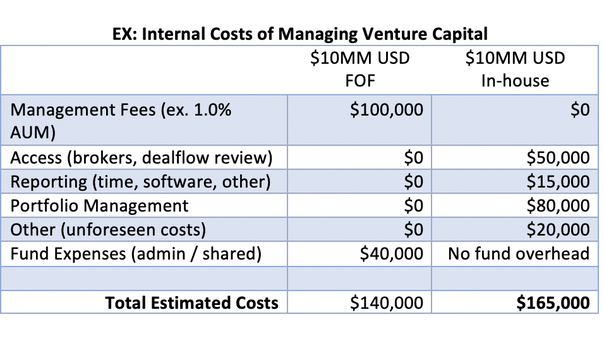

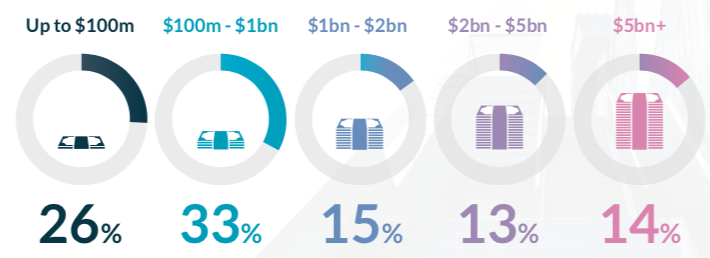

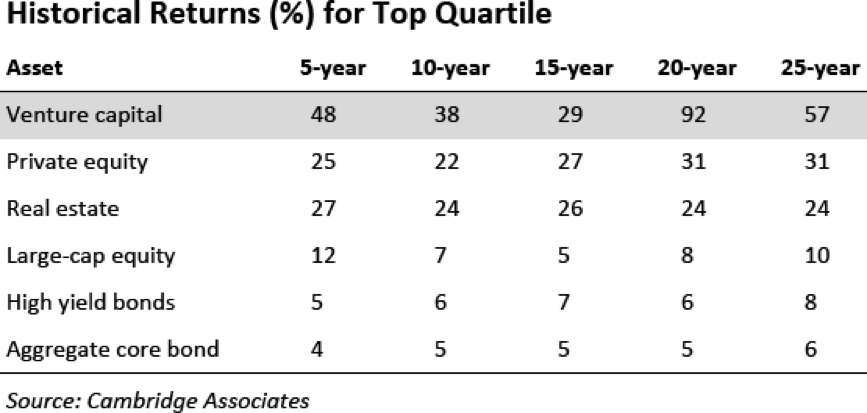

As investing into venture capital as an asset class is becoming more common than in previous decades, the interest in venture has brought in many new kinds of investors across the world, most new to the space. Some of these investors might invest into one particular venture capital fund as a one-off but assuming the price point of investing into one VC fund (usually at a min. $250,000 and max $10MM per fund) and given the high-risk nature of the asset class, the best way to apply venture capital investing with $1MM or more would be to invest into multiple venture capital funds. Some stick to the 1/3 or 3x rule; for every major win, expect one failure and one break even. If this is the case then new investors to venture capital should be investing into a couple venture funds at a time, which I think many are. Are Fund-of-Funds Worth it? There is already a mechanism for investors to invest into one central place and have those monies spread across multiple venture capital fund placements—this is a fund-of-funds or “FOF” structure (example here). If there’s already a fast-tracked way to get venture capital placement and have the risk significantly lowered, as well as shared fund costs with other investors, why wouldn’t any investor investing more than $1MM to venture capital use a fund-of-funds? The simple answer is the fees, the implied “cost.” FOFs charge management fees of around 1% assets managed, and this fee is on top of the fees that venture capital funds themselves charge for management to the FOF which is around 2%. What most investors don’t realize is that the fees in the venture capital funds comes out of the investment itself so the true “out of pocket” cost is still only 1% to the investor if they use a FOF. The worry over the “extra fees” investors might pay for a FOF is short-sighted as managing multiple venture capital investments comes with its own internal costs which I will explain below. So instead of instantly using a FOF or deciding to setup a program in-house for managing venture capital, there are some items to contemplate. Cost: Fund-of-Funds vs. In-House This is an example of an investor with $10MM for venture capital. The comparison is costs for managing venture capital investments internally vs. leveraging a FOF. [Cost calculations are based upon common adjusted fees and my own internal knowledge of FOFs operating costs and VC fund operating costs] If an investor plans to invest into more than one venture capital fund, particularly in the example above the cost is actually higher to manage internally than using a FOF. When considering managing venture capital investments in-house here are five other areas to think about when evaluating if a FOF structure could be valuable to your organization.

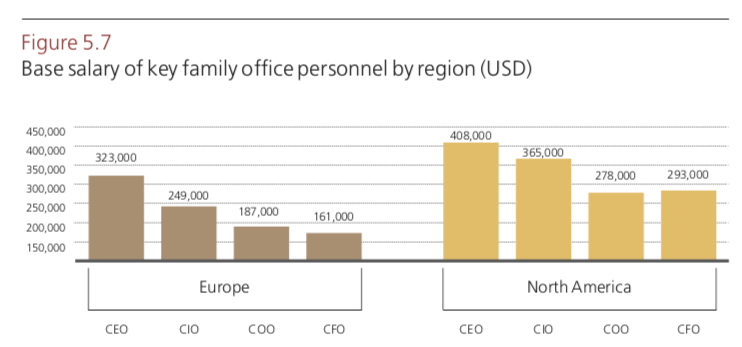

Access and Blindspots Most emerging and hot fund managers first raise investments from within their own network, so unless a FO or corporation already has direct access to founders and emerging managers, any fund pitch that naturally crosses their desk does not have verified quality. The other consideration is that 60% of founders choose to found their endeavors where they are from, so location can also change the type of dealflow an investor can get. Especially for those investors which aren’t coming with “value add” or experience which can uplift a VC fund, if it’s simply a financial transaction then the biggest concern should be VC placement or “access.” How do you vet these VC funds internally? How do you network check an unknown fund manager or otherwise make an investment decision? The time spent on answering these questions or filtering through a dozen VC funds can internally cost a FOs manager half their time for months. I listed this as $50,000 in cost above however considering most FO managers make $250,000-$450,000 annually, even half time would average $125,000-$225,000 in operating time taken up for accessing venture capital funds and doing diligence. Tracking and Reporting investments One area often overlooked by FOs and new VC LPs alike is reporting. Everything seems easy enough until there’s a couple different investments moving at different speeds, years, and traction. How are you going to consolidate the data to know how your overall performance is? One VC fund might only report twice a year, another every quarter, some will report numbers from 60-90 days from the data collection date, so at any given quarterly deadline you could have several VC reports to which you will need to find the right common data points to equally evaluate them. To make this more exciting every VC fund REPORTS DIFFERENTLY. VC fund reports come in all sizes, templates, design, what numbers they track, dates the data was collection AND each fund might list reporting in a different order. Fun. With 3+ VC fund placements, any time a FO or asset manager needs to find out overall venture capital investing performance it’s going to cost in time, software, or both. I listed this as $15,000 in cost above although its known that some software programs to assist cost thousands quarterly so the cost could easily exceed $30,000 depending on the manager. In addition to decipher the reporting the manager will need working knowledge of how startups are valued. A cool startup cap table tool for that can be found here. Portfolio Management Let’s say everything goes smooth and several venture capital fund investments have been made. The reporting puzzle has been figured out. If managing venture placement directly, there will be little things that come up: amendments to sign, changes to terms, changes of placement. It might be best for your firm to sell a positon on the secondary market, or maybe a fund manager needs to let in a new LP and has to change its own fund rules and needs your confirmation. All these little items around managing a portfolio of venture capital fund positions will certainly add up annually. I estimated this as $80,000 in the cost example above. A FO manager can expect to spend 5% or more of their time on this although the problem will be there is no planning— these items will pop up as needed and when they do can take any amount of time, usually with short urgent deadlines. The decisions themselves will affect portions of profits later on, so the time isn’t the problem it’s the expertise and thus this “on call” type of expertise is not cheap and is paid either via an internal asset managers time or outside law firms (who are even more expensive). Another example of this might be an investor is getting capital called more aggressively than expected and the manager has to go research and figure out why. VC funds in diligence (prior to investment) will give a “projected capital call schedule” to plan when they need capital yet its pretty known any later fund investors will have to catch up, and thus, be on a more aggressive capital schedule than they realized at inception. Influence as an Investor As a direct investor into a venture capital fund your % position is smaller than a FOFs position can be. This comes with collective bargaining power that cannot be competed with, so assuming changes will need to happen in the future, most investors gain more power and influence as an investor through a FOF. An example of this might be a FOF negotiates a side deal, special terms, special voting powers or access rights a FO might not even be aware existed. There is also a level of savviness that FOFs carry internally from having done more VC transactions by volume, so in the case of changes or shifts in VC positions most direct LPs who could be FOF LPs have less influence going direct. Understanding “Vintages” and Performance Another nuance in venture capital is deeply understanding how the asset class organically performs and expectations. Some examples might be, to know of certain hidden fund costs the first 1-2 years where a fund manager might (logically) hold back up to $300,000 in expenses to wait for the fund to get traction to deduct. This is common practice that shocks FOs at times so see an odd number deducted years later. Another might be a Seed stage startup that hasn’t moved a 1.0x value in 2+ years in an early stage fund that could likely be dead or a “ghost” startup. If they have not raised capital their valuation hasn’t shifted and if their valuation grew a bunch then they would have raised capital—this is the venture capital cycle. So after a while, an experienced fund manager can start calculating how much of a VC fund is “dead” and focus on the winners or, take on additional and different VC fund positions keeping this information in mind. There also needs to be patience: startups need 6-18 months to figure themselves out at the early stage so there can seemingly be no action because the startup in a venture capital fund is busy building. An expert fund manager can tell the difference between which underlying VC assets (startups) are the builders and which ones are “ghost ships” and this expertise is (1) not cheap (2) hard to find in-house. What is The Right Answer? When it comes to investing into venture capital by building a management group internally or using existing FOFs, every firm has different needs to consider so there is no one “right” answer and there are no rules—sometime the best is to balance both! For more resources or cited reports visit here. For a PDF version of this post click here. 2/20/2020 The $50BN Elephant

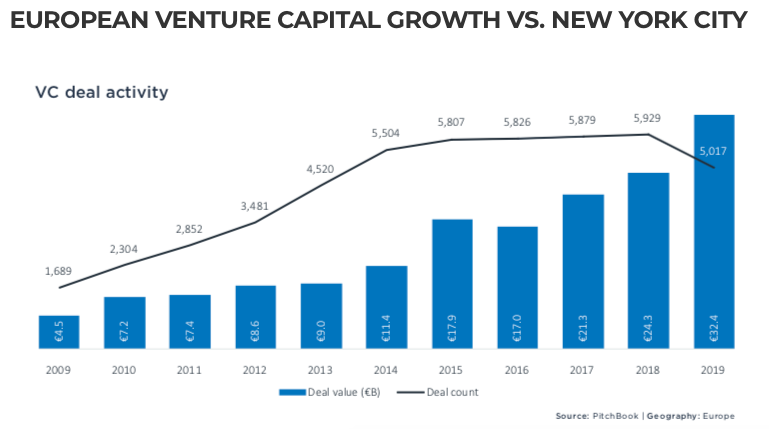

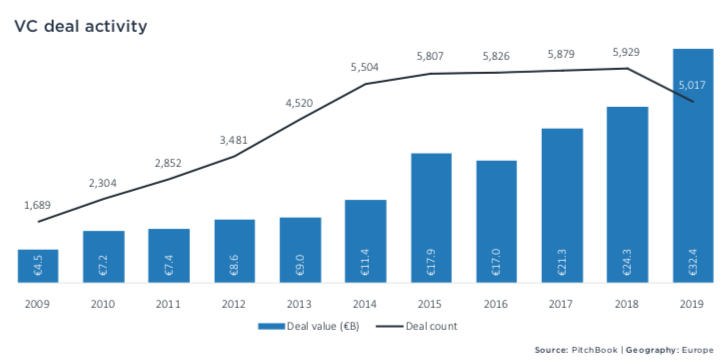

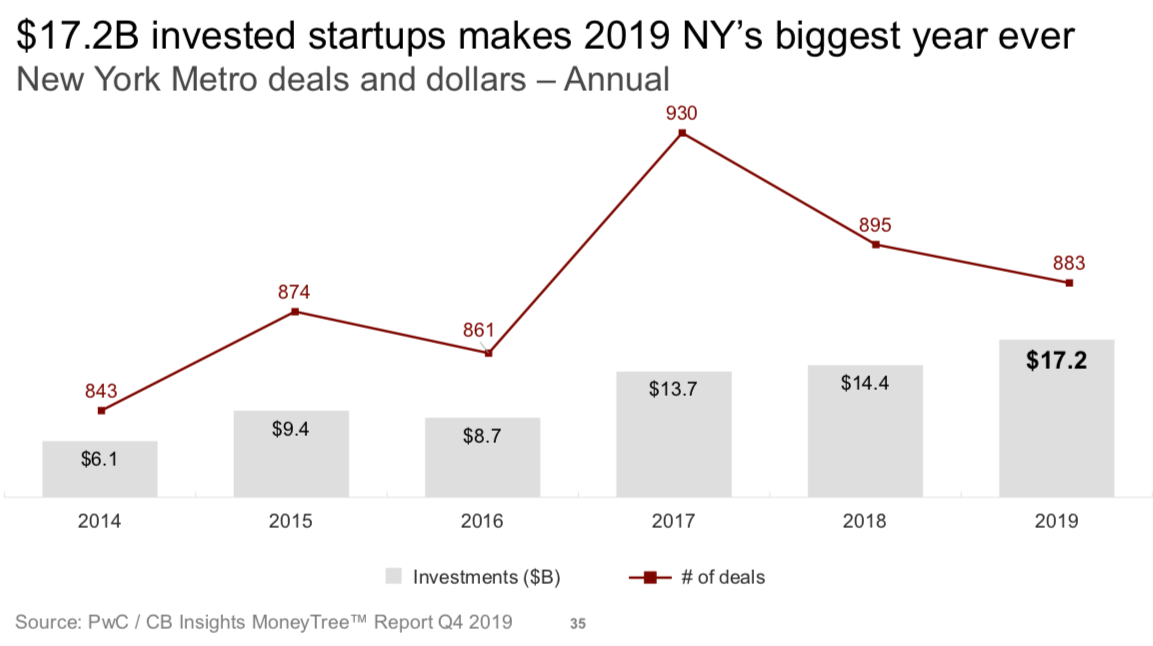

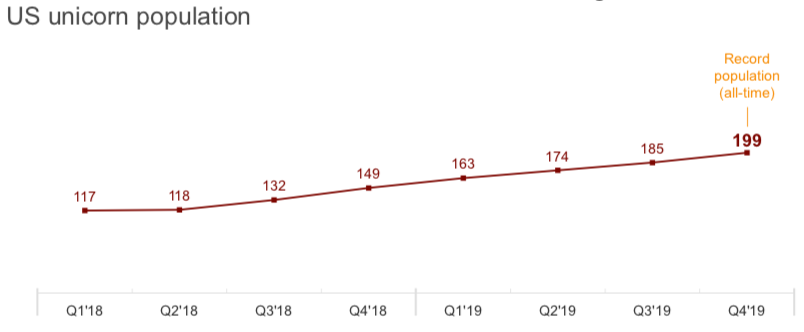

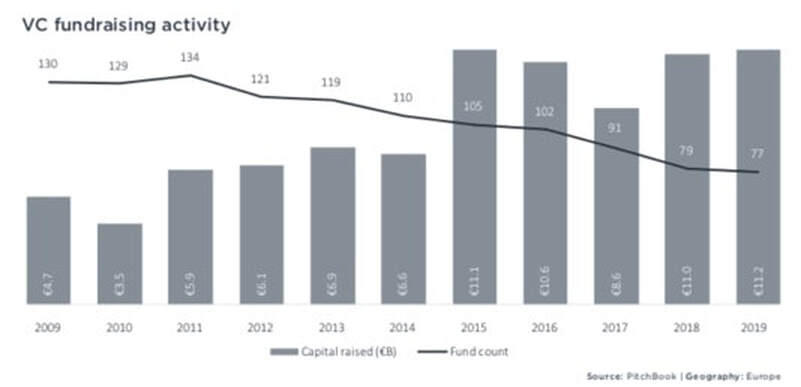

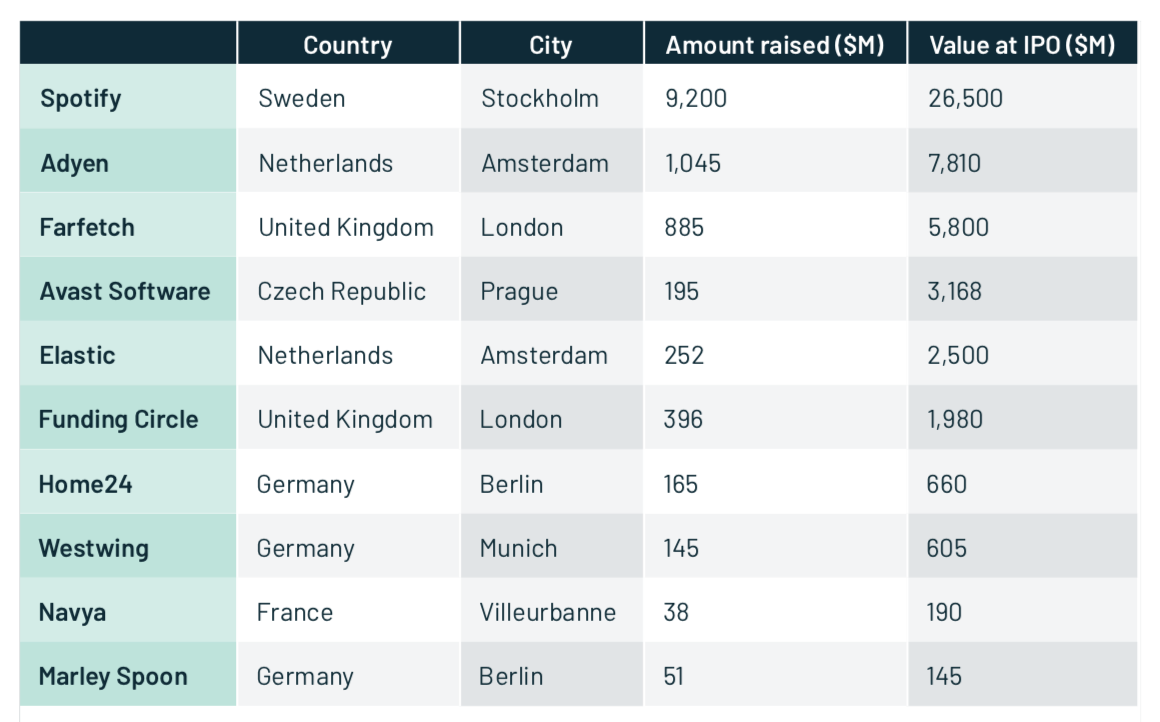

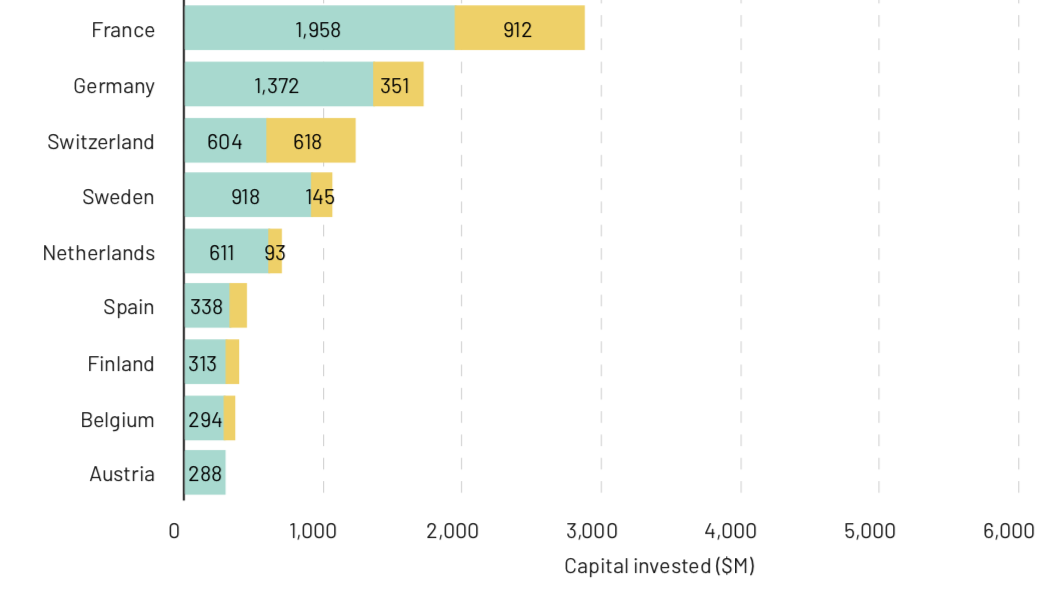

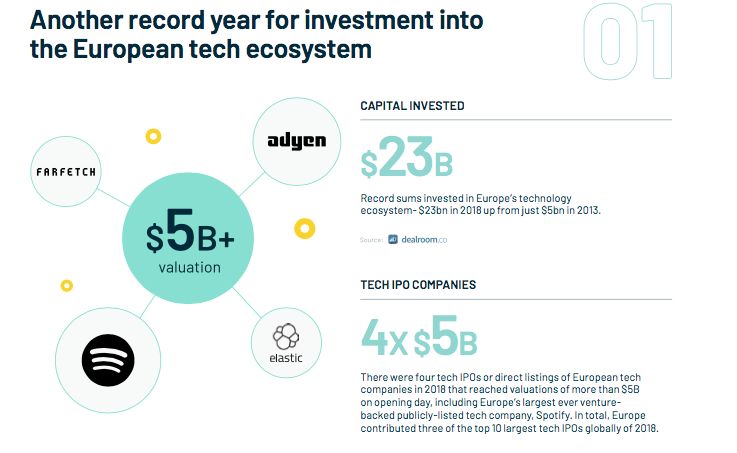

For a downloadable PDF of this click the top icon or visit Slideshare Three years ago when I arrived in Europe with the mission of creating a Fund-of-funds to help spearhead European startup growth as well as be fully global the plan seemed perfect: build a fund compliant with Europe and with the agility of American business building so the best of both worlds could be leveraged. Only while on the ground, and after considerable time working and investing in Europe, the data I was reading was not matching what I was seeing. Having lived through several emerging markets for venture capital, it can be normal for discrepancies between what has been done and what could be done, that is what ‘emerging’ is. Back in 2011 when I moved to New York, the startup scene there was new and upcoming and that is what made things exciting: there were tech events each night, startups coming together to feed and learn from each other, anyone who knew anything wanted to share and make each other better, it was really an exciting time. Back then NYC was doing less than $5BN a year in venture capital, today that number is $17.2BN for 2019. When I was asked in March 2017 if I would move to Netherlands with the concept of building a fund which could help power venture capital in Europe, the answer seemed easy. If NYC was growing so quickly surely Europe was next. EUROPEAN VENTURE CAPITAL GROWTH VS. NEW YORK CITYSource: European Venture Report 2019, Pitchbook Source: CBInsights MoneyTree Report with PWC 2020 EMERGING MARKET INDICATORS One of the biggest indicators of emerging markets, in particular with venture capital, is when the # of annual deals peak. Because of the nature of valuations, and the constraints of space and people, there are ultimately only so many startups which can launch in any given timeframe of a region, so the # of deals annually eventually will cap out before capital increases as prices go up (in this case startup valuations). In all cases there will be a ‘peak’ and this peak is when the annual deals reach their maximum # but the capital pricing has not reached potential yet. Its hard to know when a peak is happening until data from the later years follow. Once the annual deal count stabilizes, several years will follow where capital will steadily increase before reaching full potential.

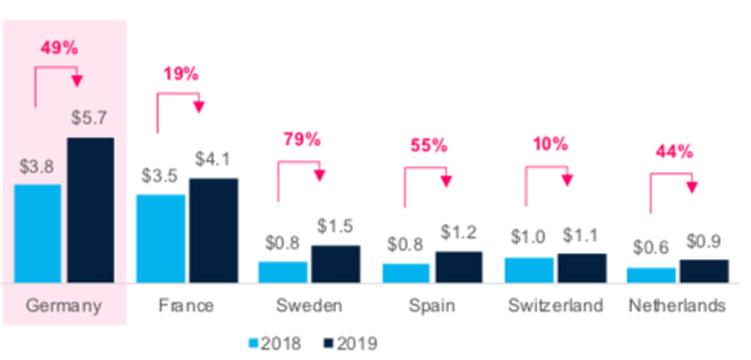

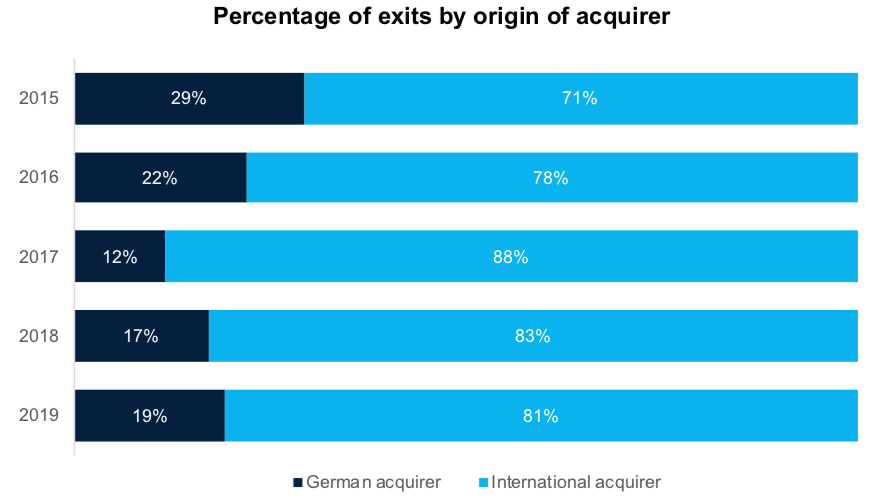

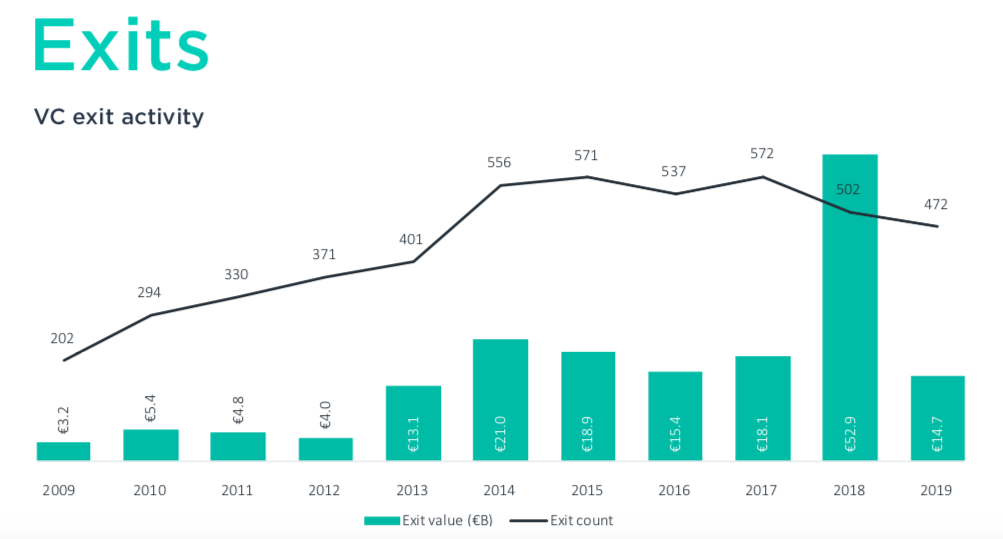

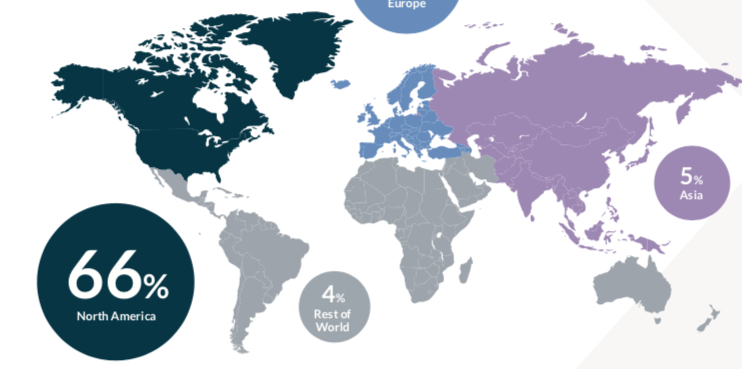

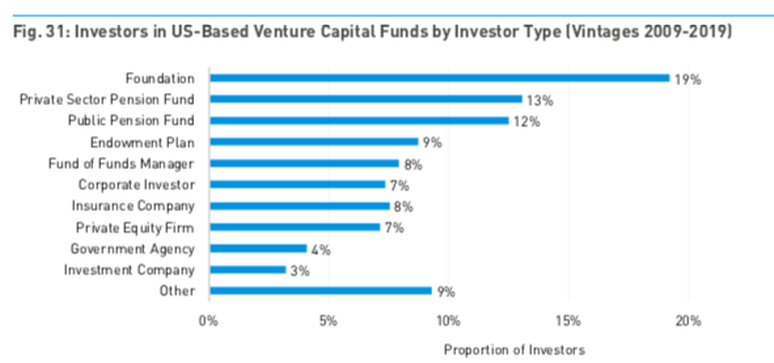

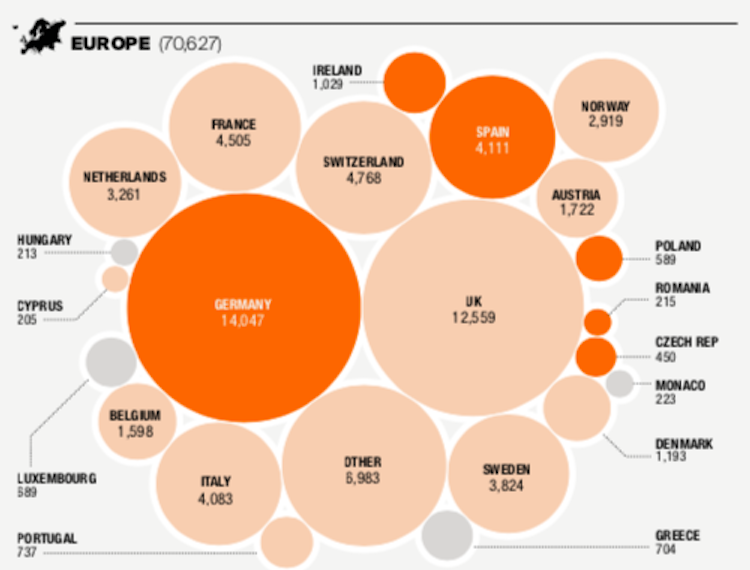

Assumptions about European venture growth (back in 2017):

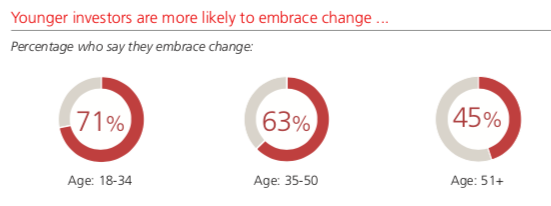

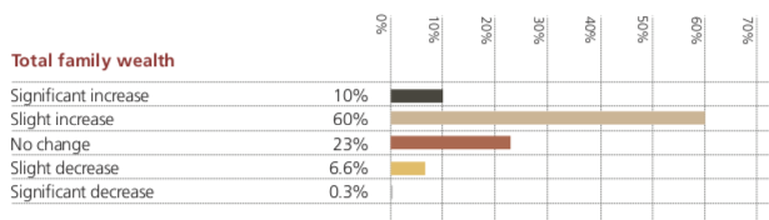

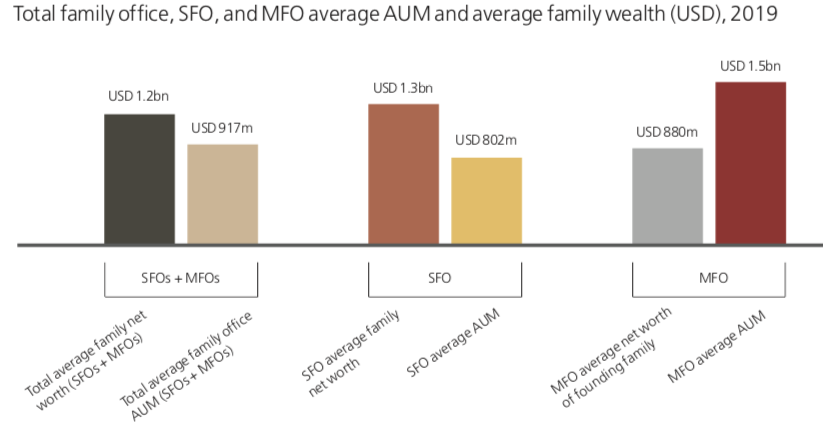

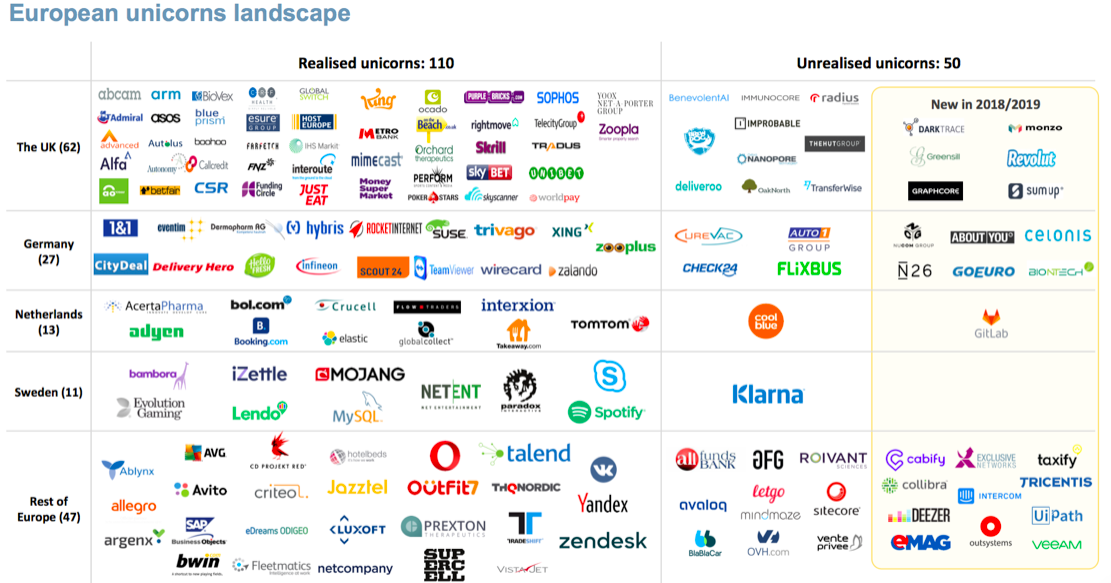

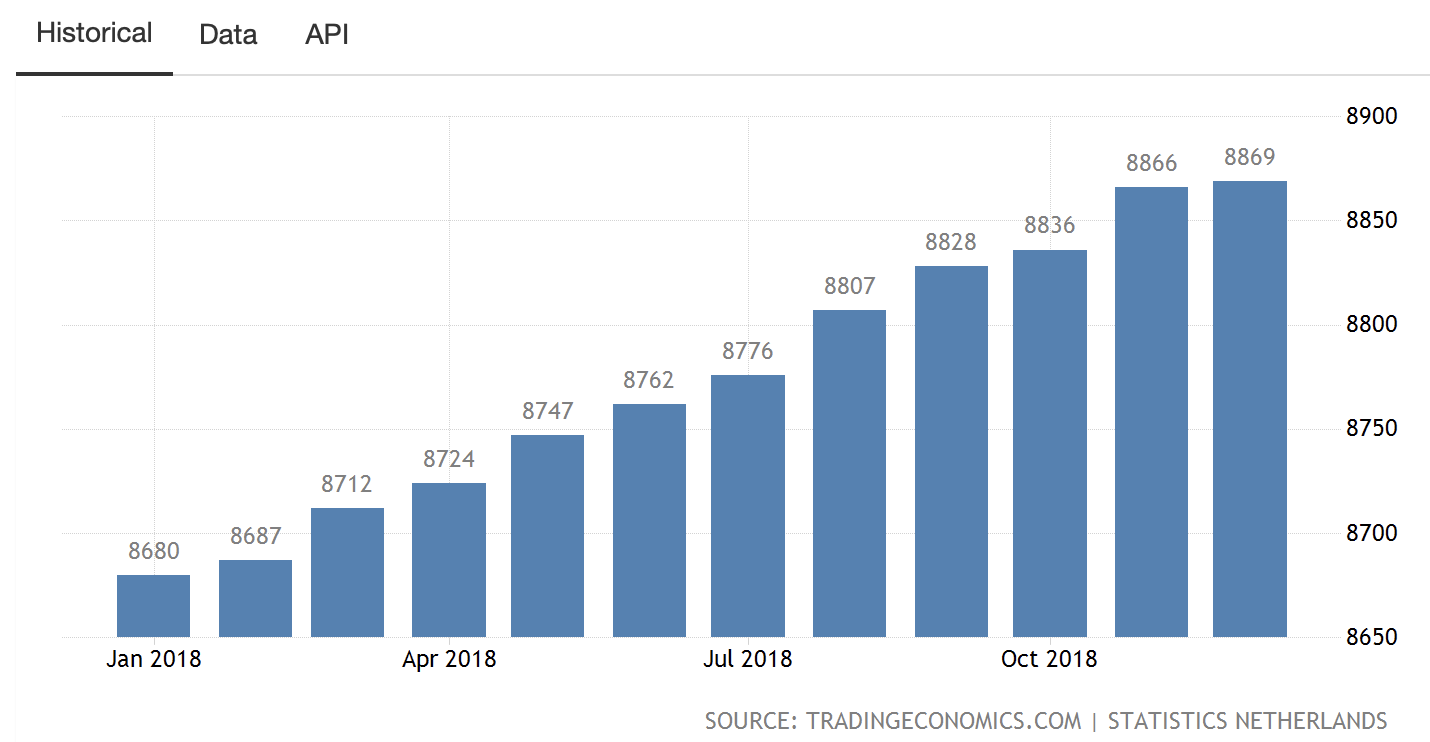

From my calculations Europe seemed ripe for deploying venture capital and growing it. As an emerging market all the signs of hyper-growth were there: growing labor pool of expertise, mobility conditions, political stability and of course as seen above, resources of capital. THE EUROPEAN ANAMOLY Throughout the years I kept checking various data points on Europe and LATAM getting confused. Many reports were showing capital growth with Europe on a NYC-like trajectory, but on the ground so much was missing in the ecosystem that most EU startup founders didn’t know what a termsheet was or how to value their company. How could this be? Other reports showed LATAM didn’t have much in capital, yet Latin startups are growing and scaling like crazy. It didn’t make sense. Despite being invited to help create a fund-of-funds for Europeans, via Europe, many Europeans are still skeptical of venture capital because no one they know directly have profited from it. Netherlands specifically has its own set of issues despite having one of the largest growing workforces in Europe, political stability and access to capital, NL has not been progressing much for VC. A 2020 report from TechLeap.NL specifically lists some of the issues as lack of access to top technology talent, knowledge of termsheets and lack of investor momentum This Dutch report explicitly states the need for a “Public-private fund of funds structure to attract and boost VC funds that invest across funding stages” but that is exactly what my fund is and the Dutch ecosystem still is not moving, however Dealroom and various report make it appear that Europe VC is on the rise, how is this possible? Here is a detailed look at European VC by country: Source: German Venture Capital Landscape Report 2020, Whitestar Capital As can be seen on the country level, the YOY growth for EU venture capital is not particularly markable. Even Italy has been unofficially reporting €1.5BN and with the average global family office having $1BN assets under management, one or two family offices could easily sway these numbers. Any particular EU pension could also shift VC growth numbers, and yet it’s not happening, why? Because the capital coming into Europe is mainly American capital one way or the other. The acquirers of European startups? Also, American. It’s not explicitly listed out but even when looking at Germany’s exits 81% were done by “international acquirers” which is a mix of mainly American and some Chinese capital. Source: German Venture Capital Landscape Report 2020, Whitestar Capital Data powered by Pitchbook (link) When looking at overall European exits we see the # of deals plateauing, with the average exit being €31MM, aside from outliers in 2018. In the U.S $31MM is the average size of a Series B funding round so Europe is still “emerging” with good pricing but it’s very far from being mature. Source: European Venture Report 2019 Annual, Pitchbook If we take an even closer look at a different set of data we see again, outliers aside, $31MM is the acquisition sweetspot for European companies which makes sense in general because statistically companies $100MM or under have a greater chance of being acquired due to corporate affordability. We can infer from this the EU acquisition $ averages will go up but the total market cap is likely €75BN Source: State of European Tech 2019, Atomico / Dealroom WHO ARE THE LPS OF EUROPE? If we know that funding is happening in Europe as well as exits, but we also know that EU pensions are not even 0.01% engaged with venture capital, and European family offices only make up about 3BN a year for venture in Europe, then who are all the LPs of Europe? Again we know 70% or more of EU venture is actually American capital. 11% of American Venture Capital comes from Europe too, so Europe is investing into America, to invest into Europe, in a cycle which mainly profits the U.S. According to several reports including UBS’ Investor Watch Report We know that 65% of founders prefer to start something where they are, that means European founders are founding wherever they are. We also know 7 out of 10 investors want to hedge on “mega-trends” that is why we see many European startups as EU versions or types of companies that do well in America, but this doesn’t always work out the same in Europe. If we look at the demographic of investors for venture, those under 35 tend to be almost twice as likely to embrace change and exert flexibility: Source: UBS Investor Watch Report Year Ahead (LINK) Ironically the average age a manager takes control of a FO is 40-45 years old so we can see here a new wave of managers coming into play and before the next generation takes control wealth is already up 70% Other data sources, Like FINTRX also confirm that the average family office is about $1BN in size. FAMILY OFFICE ASSETS UNDER MANAGEMENT Source: FINTRX Family Office Industry Report, 2019 66% of family offices in the world are based in North America with about 25% being in Europe but if Europe family offices invested 3BN last year into venture capital, this 25% might as well be 0.05% in relevance for venture capital. Source:FINTRX Family Office Industry Report, 2019 If we look towards the U.S to get more insights on how LP and investor categories breakdown we can see quite clearly the common types of investors, as explained by Preqin and First Republic Bank Source:Prequin and First Republic Bank US Venture Capital in Q3 2019 (LINK) The U.S market is pretty clear that the LP base of venture capital usually ends up in four main categories: Foundations, Pensions, Family Offices, and Other. If there’s currently a 50BN opportunity for Europe, and if it is to act similar to the U.S market, that would be 12.5BN per LP category. If we know 3BN of European venture capital is coming from European FOsthen the market is 1/4 maximized in that category alone. It would appear of all the types of LPs EU FOs and EU pensions are likely to have the hardest time getting a slice of the venture capital pie and yet they continue to wait and not sense any investment urgency. SITTING ON THE SIDELINESBy reverse calculating the market opportunity of Europe which is currently at 30BN annually (for venture capital) it is very likely the market will cap out at around 75BN including assumptions for growth, price increases and currency fluctuations. This leaves 45BN unassigned in European venture to be gained upon, again 50BN. With the UK having left the European Union, that means EU venture potential has both cut in half and doubled at the same time and here’s why: on one hand London has always been a major hub for talent and capital, however with the UK out of the EU, talent opportunities have dropped to import skilled workers so mobility has dramatically decreased. On the other hand, taking out British investors as LPs into Europe creates more room for either American’s to take up marketshare or Europeans to finally jump in and get a piece. On a high level that means about 12BN annually has opened up for the EU community LPs to jump on, assuming the Americans do not beat them to it. Below is an infographic which shows how big the UK had been in the European wealth market as compared to several regions and prior to Brexit Source: The Wealth Report, Knight Frank (LINK) If we assume the current European VC market is 30BN, and American capital conservatively accounts for 50% or more of this (say 15BN), and Brexit has taken UK capital off the table for the future (13BN) and startup prices will continue to rise over the coming years (even at a rate of 30%) this would mean there’s about 50BN on the table over the coming years, and specifically all that’s left for European investors! With only 50BN for EU pensions, family offices, individuals and HNW, this is nothing. If the average EU family office invested only 2% of their AUM that would allow for $20MM per family office or room for about 500 family offices to get involved with venture capital. However, its known statistically that often FOs, when they DO invest into venture its closer to 15-30% of AUM. On the conservative side of things, and accounting for room in this 50BN opportunity for pensions and individuals, European venture capital in the future only has room for about 125 family offices to participate. In several simulations that I ran, this number could be as low as 50 slots for FOs. THE GREAT RACE TO MARKETSHAREIf the US venture capital market is the closest in comparison to Europe, we can see both (1) the EU market cap will not surpass 100BN and (2) strategically every few years 10-15BN of American capital is diversified to Europe nearly automatically For example, 2019 data might indicate a ‘decline’ but it also indicates capital was diverted from the US to EU to reduce risk and maximize better European price points. THE ALLURE OF EUROPEAN AFFORDABILITYThe Dutch government estimates that 12,000 additional skilled workers a year are needed to assist with growing and scaling startups. Germany, who’s market is 3x Netherlands would need even more. As a whole, it’s likely that Europe will need 100,000 jobs a year to sustain venture capital growth and scalable companies. Even with EU unemployment at an all-time low (under 4% in most European regions) there still is not enough people to power hyper growth aka “unicorns.” In 2019 Netherlands was home to 12 unicorn companies and Germany 9. Estimates are that Europe has about 30 unicorns in total in its region. The U.S recorded 199 unicorns in its pipeline Referencing these data points, it’s likely that Europe’s unicorn cap in optimal conditions is somewhere around 100 so the EU VC market is 1/3 of the way matured. On a positive note we see European VC funds decreasing in volume (# of funds) and increasing in the capital that is in them. EU VC funds becoming bigger in size is an indicator of market maturity but it’s not a reflection of European operated maturity or labor expertise. This “growth” of European VC is happening on the accord of American capital infusing the market which is helping American investors profits but not necessarily helping the EU. GLOBAL FLOW OF VENTURE CAPITALSo, what does this all mean? In my case it means that I launched my fund backwards: I should have raised the funds in the U.S and deployed them in Europe—versus raising in Europe and trying to deploy globally. It also means Europe is in great danger of not owning its own marketshare or controlling its destiny. It also means that European citizens are missing out on the possible gains that their pensions could be making them by investing into venture capital while also generating jobs. When I review again reports from Netherlands and Europe I see that despite evenmy own efforts to help the ecosystem, European investors have not budged in movement nor understand the gravity of the situation. I moved to Netherlands in April 2017 and nearly three years later do not see any signs on the ground that people are excited and learning about venture capital the way New York does and has in the past. This is presenting itself as quite the awkward situation for fund managers like myself, when we know that fund managers are paid 30% more working in North America vs. Europe: It is also known that funds raising in the U.S can often take 18 months to fill their fund and this is in ideal hyper-fast conditions with investors savvy in the asset product, so I can only imagine European funds need twice as much time (36 months to fundraise) and in this time can miss out on entire vintages and opportunities. It also seems clear to me without a more robust labor force and cultural appreciation for the kind of hard work running Unicorns take, if Europe wants to be a major player in venture capital it will have to come to a compromise with many of its cultural norms. And lastly, when I think about all that I have seen and experienced the last few years it seems obvious to me that if Europe does not quickly become familiar with venture capital and investing into itself it might miss the boat altogether. From a global perspective the EU VC market will continue to grow whether or not European investors figure it out in time, which means the people benefiting the most off European growth are not actually Europeans which explains why there is such slow movement with EU LPs and talent. It also means the European market is at risk of not reaching its potential if those on the ground do not care or understand what’s going on the way other regions do. At the end of the day it seems that Europeans need to be honest with themselves about the 50BN elephant in the room, before the elephant is gone. --------------------------------------------------------------------------------------------- INDUSTRY REPORTS AND CITATIONS: