|

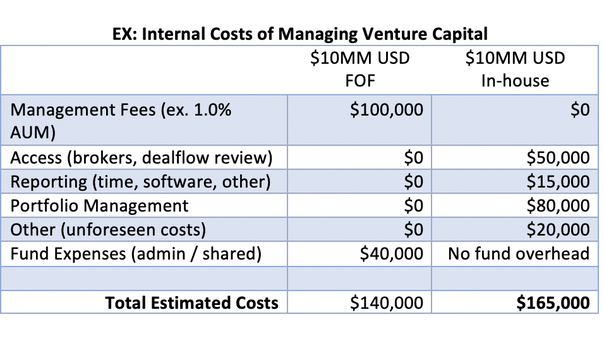

As investing into venture capital as an asset class is becoming more common than in previous decades, the interest in venture has brought in many new kinds of investors across the world, most new to the space. Some of these investors might invest into one particular venture capital fund as a one-off but assuming the price point of investing into one VC fund (usually at a min. $250,000 and max $10MM per fund) and given the high-risk nature of the asset class, the best way to apply venture capital investing with $1MM or more would be to invest into multiple venture capital funds. Some stick to the 1/3 or 3x rule; for every major win, expect one failure and one break even. If this is the case then new investors to venture capital should be investing into a couple venture funds at a time, which I think many are. Are Fund-of-Funds Worth it? There is already a mechanism for investors to invest into one central place and have those monies spread across multiple venture capital fund placements—this is a fund-of-funds or “FOF” structure (example here). If there’s already a fast-tracked way to get venture capital placement and have the risk significantly lowered, as well as shared fund costs with other investors, why wouldn’t any investor investing more than $1MM to venture capital use a fund-of-funds? The simple answer is the fees, the implied “cost.” FOFs charge management fees of around 1% assets managed, and this fee is on top of the fees that venture capital funds themselves charge for management to the FOF which is around 2%. What most investors don’t realize is that the fees in the venture capital funds comes out of the investment itself so the true “out of pocket” cost is still only 1% to the investor if they use a FOF. The worry over the “extra fees” investors might pay for a FOF is short-sighted as managing multiple venture capital investments comes with its own internal costs which I will explain below. So instead of instantly using a FOF or deciding to setup a program in-house for managing venture capital, there are some items to contemplate. Cost: Fund-of-Funds vs. In-House This is an example of an investor with $10MM for venture capital. The comparison is costs for managing venture capital investments internally vs. leveraging a FOF. [Cost calculations are based upon common adjusted fees and my own internal knowledge of FOFs operating costs and VC fund operating costs] If an investor plans to invest into more than one venture capital fund, particularly in the example above the cost is actually higher to manage internally than using a FOF. When considering managing venture capital investments in-house here are five other areas to think about when evaluating if a FOF structure could be valuable to your organization.

Access and Blindspots Most emerging and hot fund managers first raise investments from within their own network, so unless a FO or corporation already has direct access to founders and emerging managers, any fund pitch that naturally crosses their desk does not have verified quality. The other consideration is that 60% of founders choose to found their endeavors where they are from, so location can also change the type of dealflow an investor can get. Especially for those investors which aren’t coming with “value add” or experience which can uplift a VC fund, if it’s simply a financial transaction then the biggest concern should be VC placement or “access.” How do you vet these VC funds internally? How do you network check an unknown fund manager or otherwise make an investment decision? The time spent on answering these questions or filtering through a dozen VC funds can internally cost a FOs manager half their time for months. I listed this as $50,000 in cost above however considering most FO managers make $250,000-$450,000 annually, even half time would average $125,000-$225,000 in operating time taken up for accessing venture capital funds and doing diligence. Tracking and Reporting investments One area often overlooked by FOs and new VC LPs alike is reporting. Everything seems easy enough until there’s a couple different investments moving at different speeds, years, and traction. How are you going to consolidate the data to know how your overall performance is? One VC fund might only report twice a year, another every quarter, some will report numbers from 60-90 days from the data collection date, so at any given quarterly deadline you could have several VC reports to which you will need to find the right common data points to equally evaluate them. To make this more exciting every VC fund REPORTS DIFFERENTLY. VC fund reports come in all sizes, templates, design, what numbers they track, dates the data was collection AND each fund might list reporting in a different order. Fun. With 3+ VC fund placements, any time a FO or asset manager needs to find out overall venture capital investing performance it’s going to cost in time, software, or both. I listed this as $15,000 in cost above although its known that some software programs to assist cost thousands quarterly so the cost could easily exceed $30,000 depending on the manager. In addition to decipher the reporting the manager will need working knowledge of how startups are valued. A cool startup cap table tool for that can be found here. Portfolio Management Let’s say everything goes smooth and several venture capital fund investments have been made. The reporting puzzle has been figured out. If managing venture placement directly, there will be little things that come up: amendments to sign, changes to terms, changes of placement. It might be best for your firm to sell a positon on the secondary market, or maybe a fund manager needs to let in a new LP and has to change its own fund rules and needs your confirmation. All these little items around managing a portfolio of venture capital fund positions will certainly add up annually. I estimated this as $80,000 in the cost example above. A FO manager can expect to spend 5% or more of their time on this although the problem will be there is no planning— these items will pop up as needed and when they do can take any amount of time, usually with short urgent deadlines. The decisions themselves will affect portions of profits later on, so the time isn’t the problem it’s the expertise and thus this “on call” type of expertise is not cheap and is paid either via an internal asset managers time or outside law firms (who are even more expensive). Another example of this might be an investor is getting capital called more aggressively than expected and the manager has to go research and figure out why. VC funds in diligence (prior to investment) will give a “projected capital call schedule” to plan when they need capital yet its pretty known any later fund investors will have to catch up, and thus, be on a more aggressive capital schedule than they realized at inception. Influence as an Investor As a direct investor into a venture capital fund your % position is smaller than a FOFs position can be. This comes with collective bargaining power that cannot be competed with, so assuming changes will need to happen in the future, most investors gain more power and influence as an investor through a FOF. An example of this might be a FOF negotiates a side deal, special terms, special voting powers or access rights a FO might not even be aware existed. There is also a level of savviness that FOFs carry internally from having done more VC transactions by volume, so in the case of changes or shifts in VC positions most direct LPs who could be FOF LPs have less influence going direct. Understanding “Vintages” and Performance Another nuance in venture capital is deeply understanding how the asset class organically performs and expectations. Some examples might be, to know of certain hidden fund costs the first 1-2 years where a fund manager might (logically) hold back up to $300,000 in expenses to wait for the fund to get traction to deduct. This is common practice that shocks FOs at times so see an odd number deducted years later. Another might be a Seed stage startup that hasn’t moved a 1.0x value in 2+ years in an early stage fund that could likely be dead or a “ghost” startup. If they have not raised capital their valuation hasn’t shifted and if their valuation grew a bunch then they would have raised capital—this is the venture capital cycle. So after a while, an experienced fund manager can start calculating how much of a VC fund is “dead” and focus on the winners or, take on additional and different VC fund positions keeping this information in mind. There also needs to be patience: startups need 6-18 months to figure themselves out at the early stage so there can seemingly be no action because the startup in a venture capital fund is busy building. An expert fund manager can tell the difference between which underlying VC assets (startups) are the builders and which ones are “ghost ships” and this expertise is (1) not cheap (2) hard to find in-house. What is The Right Answer? When it comes to investing into venture capital by building a management group internally or using existing FOFs, every firm has different needs to consider so there is no one “right” answer and there are no rules—sometime the best is to balance both! For more resources or cited reports visit here. For a PDF version of this post click here. Comments are closed.

|

common tags |

RSS Feed

RSS Feed