|

2/20/2020 The $50BN Elephant

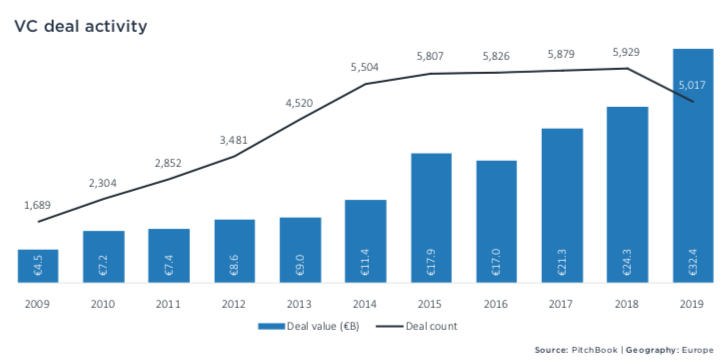

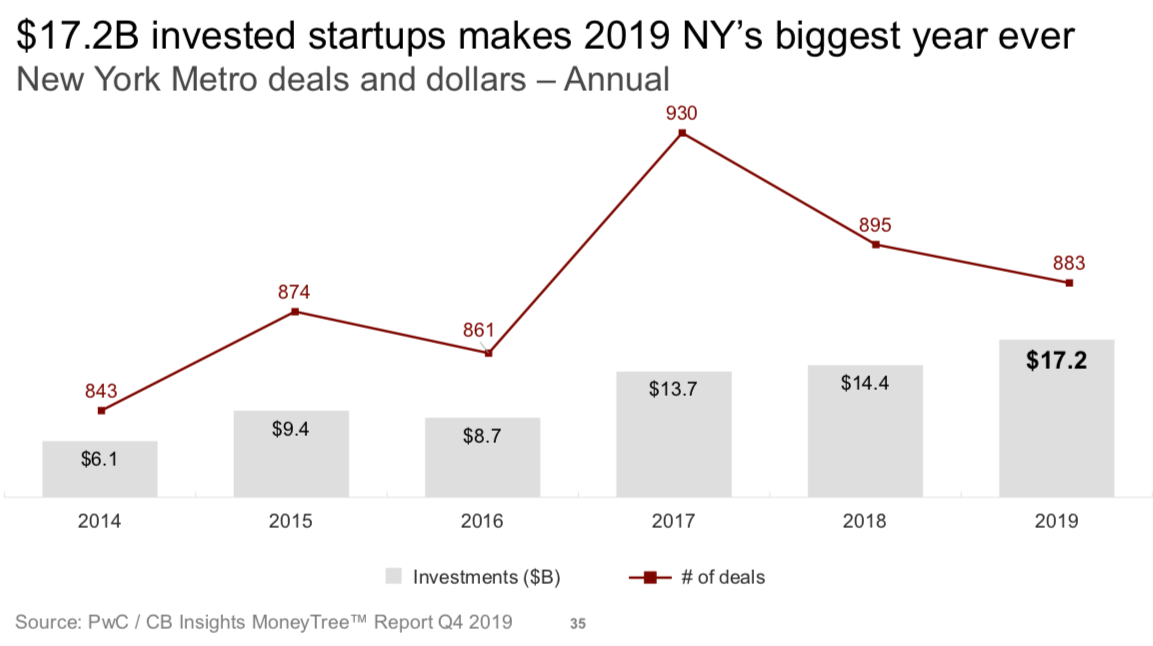

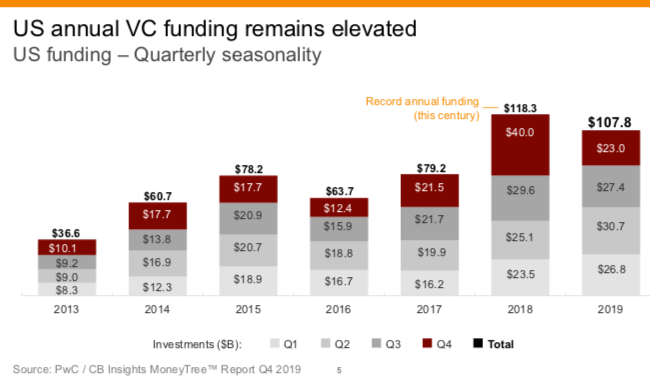

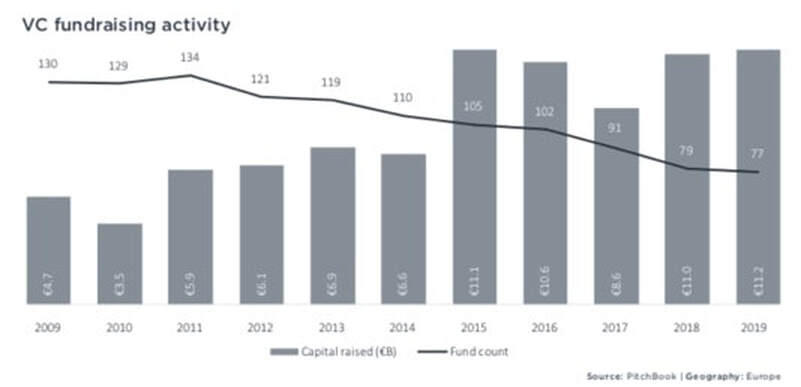

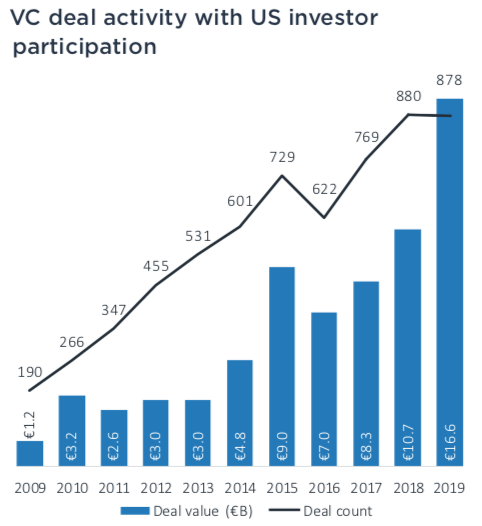

For a downloadable PDF of this click the top icon or visit Slideshare Three years ago when I arrived in Europe with the mission of creating a Fund-of-funds to help spearhead European startup growth as well as be fully global the plan seemed perfect: build a fund compliant with Europe and with the agility of American business building so the best of both worlds could be leveraged. Only while on the ground, and after considerable time working and investing in Europe, the data I was reading was not matching what I was seeing. Having lived through several emerging markets for venture capital, it can be normal for discrepancies between what has been done and what could be done, that is what ‘emerging’ is. Back in 2011 when I moved to New York, the startup scene there was new and upcoming and that is what made things exciting: there were tech events each night, startups coming together to feed and learn from each other, anyone who knew anything wanted to share and make each other better, it was really an exciting time. Back then NYC was doing less than $5BN a year in venture capital, today that number is $17.2BN for 2019. When I was asked in March 2017 if I would move to Netherlands with the concept of building a fund which could help power venture capital in Europe, the answer seemed easy. If NYC was growing so quickly surely Europe was next. EUROPEAN VENTURE CAPITAL GROWTH VS. NEW YORK CITYSource: European Venture Report 2019, Pitchbook Source: CBInsights MoneyTree Report with PWC 2020 EMERGING MARKET INDICATORS One of the biggest indicators of emerging markets, in particular with venture capital, is when the # of annual deals peak. Because of the nature of valuations, and the constraints of space and people, there are ultimately only so many startups which can launch in any given timeframe of a region, so the # of deals annually eventually will cap out before capital increases as prices go up (in this case startup valuations). In all cases there will be a ‘peak’ and this peak is when the annual deals reach their maximum # but the capital pricing has not reached potential yet. Its hard to know when a peak is happening until data from the later years follow. Once the annual deal count stabilizes, several years will follow where capital will steadily increase before reaching full potential.

Assumptions about European venture growth (back in 2017):

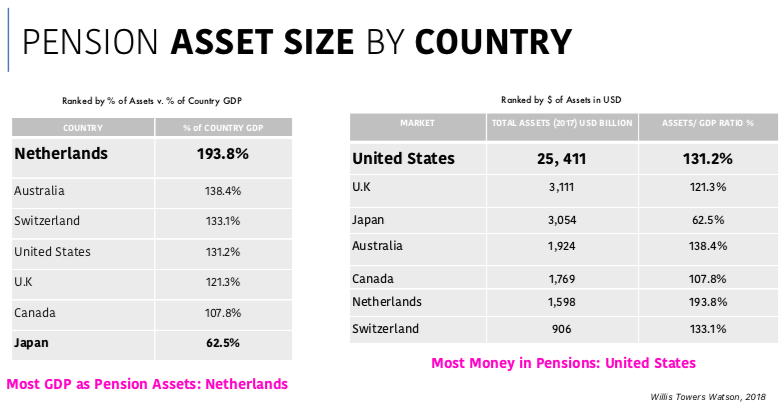

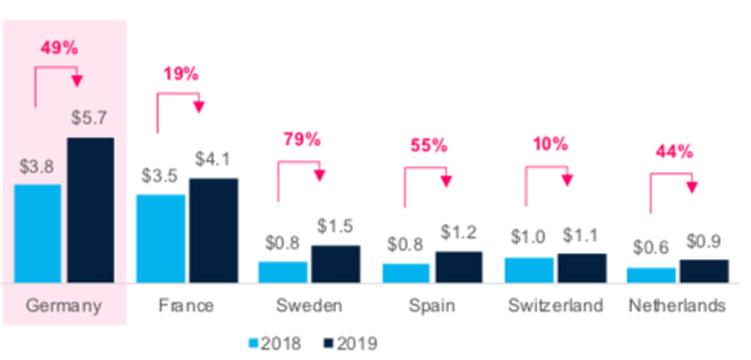

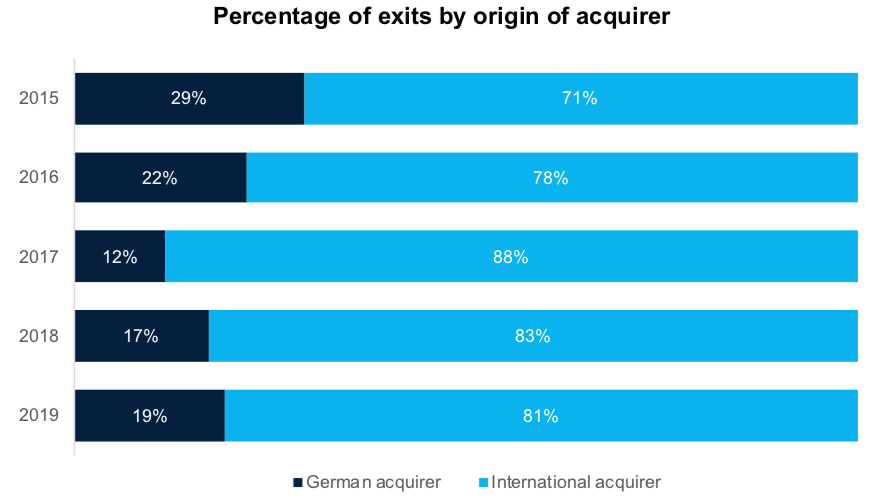

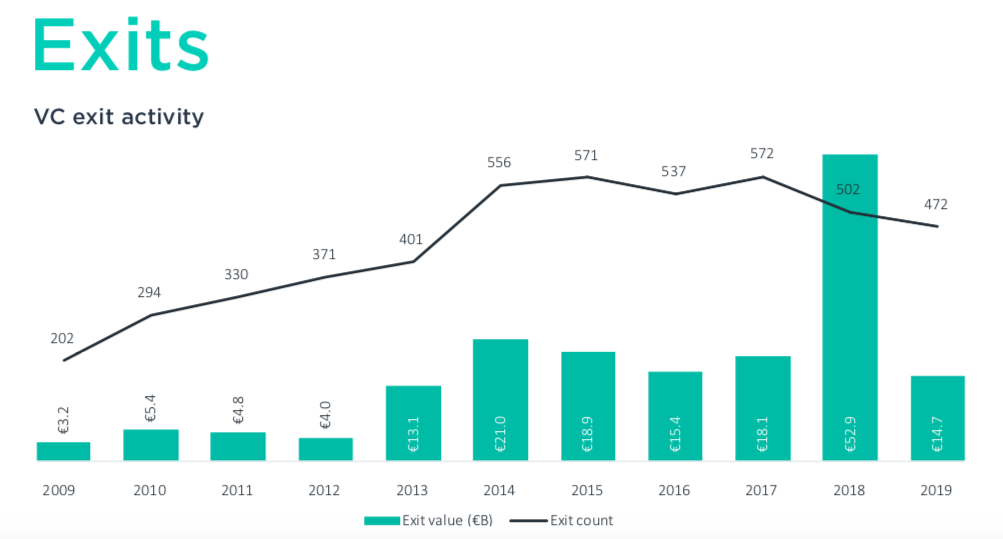

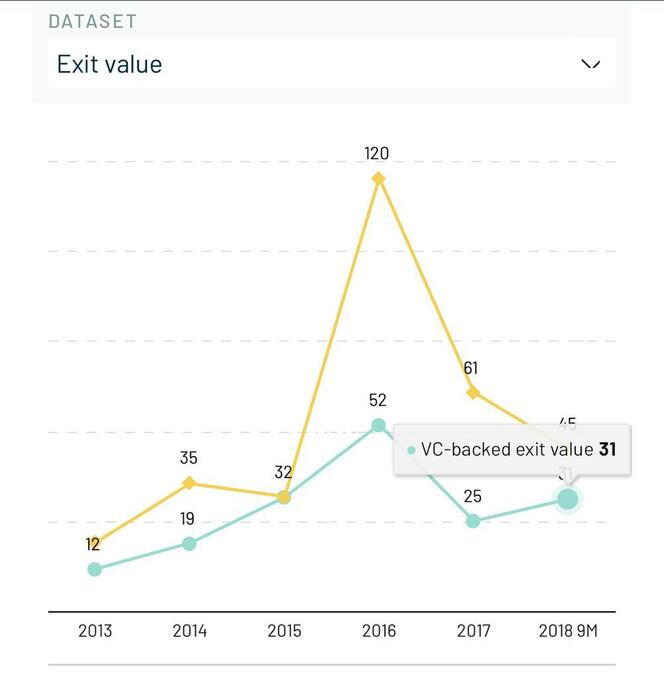

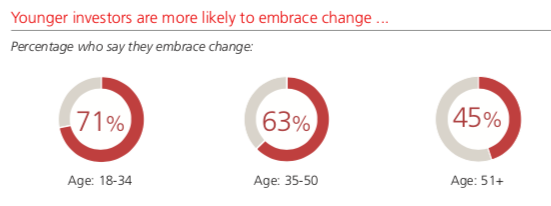

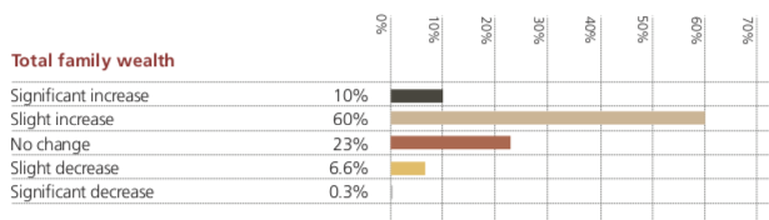

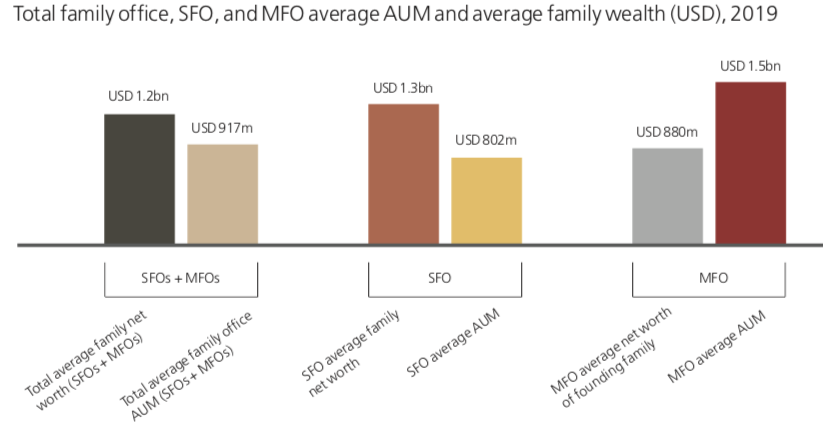

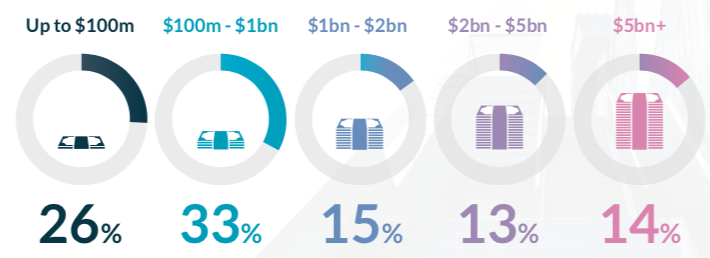

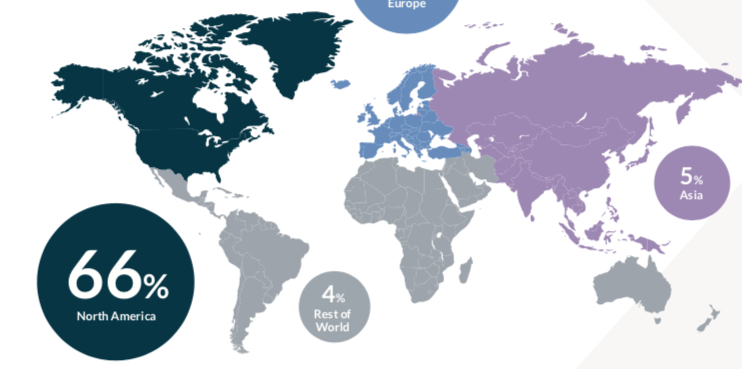

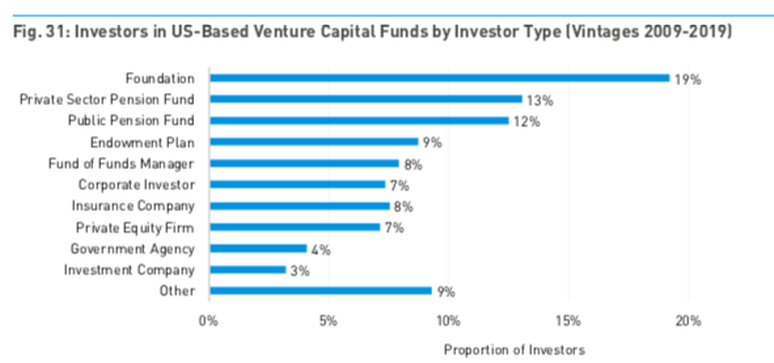

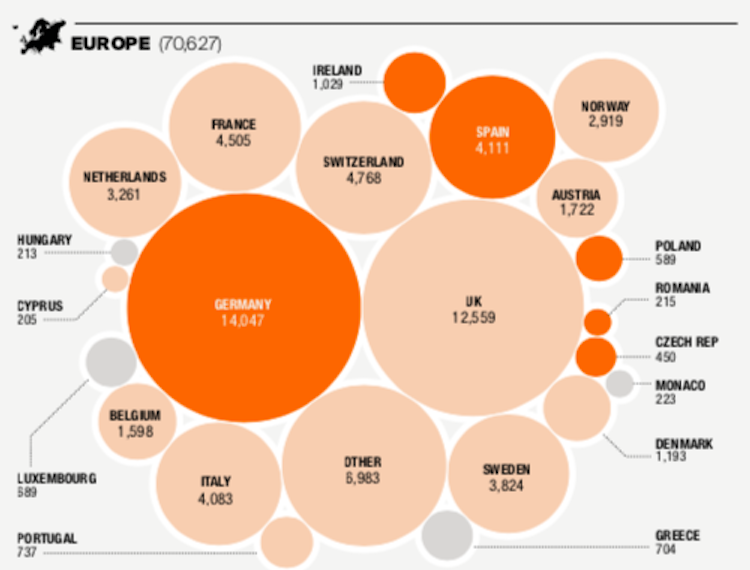

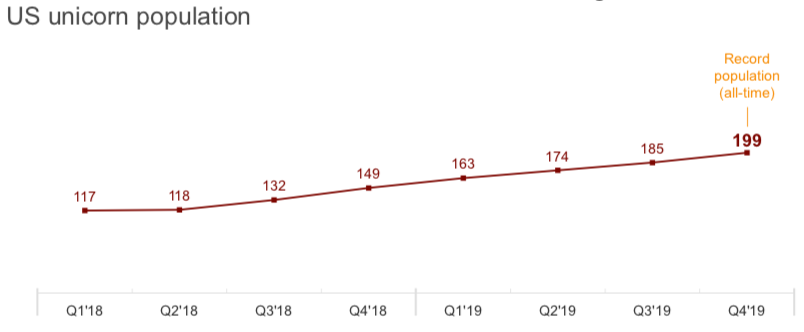

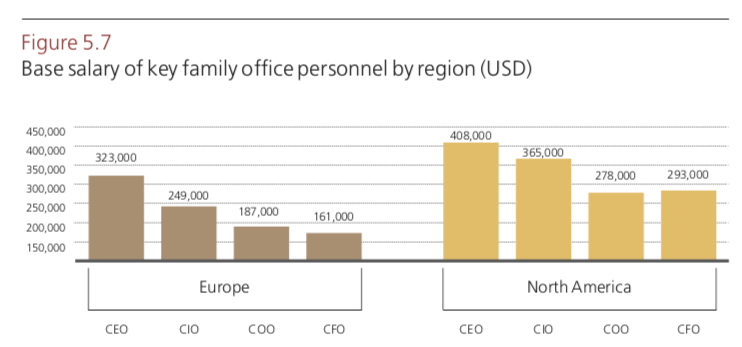

From my calculations Europe seemed ripe for deploying venture capital and growing it. As an emerging market all the signs of hyper-growth were there: growing labor pool of expertise, mobility conditions, political stability and of course as seen above, resources of capital. THE EUROPEAN ANAMOLY Throughout the years I kept checking various data points on Europe and LATAM getting confused. Many reports were showing capital growth with Europe on a NYC-like trajectory, but on the ground so much was missing in the ecosystem that most EU startup founders didn’t know what a termsheet was or how to value their company. How could this be? Other reports showed LATAM didn’t have much in capital, yet Latin startups are growing and scaling like crazy. It didn’t make sense. Despite being invited to help create a fund-of-funds for Europeans, via Europe, many Europeans are still skeptical of venture capital because no one they know directly have profited from it. Netherlands specifically has its own set of issues despite having one of the largest growing workforces in Europe, political stability and access to capital, NL has not been progressing much for VC. A 2020 report from TechLeap.NL specifically lists some of the issues as lack of access to top technology talent, knowledge of termsheets and lack of investor momentum This Dutch report explicitly states the need for a “Public-private fund of funds structure to attract and boost VC funds that invest across funding stages” but that is exactly what my fund is and the Dutch ecosystem still is not moving, however Dealroom and various report make it appear that Europe VC is on the rise, how is this possible? Here is a detailed look at European VC by country: Source: German Venture Capital Landscape Report 2020, Whitestar Capital As can be seen on the country level, the YOY growth for EU venture capital is not particularly markable. Even Italy has been unofficially reporting €1.5BN and with the average global family office having $1BN assets under management, one or two family offices could easily sway these numbers. Any particular EU pension could also shift VC growth numbers, and yet it’s not happening, why? Because the capital coming into Europe is mainly American capital one way or the other. The acquirers of European startups? Also, American. It’s not explicitly listed out but even when looking at Germany’s exits 81% were done by “international acquirers” which is a mix of mainly American and some Chinese capital. Source: German Venture Capital Landscape Report 2020, Whitestar Capital Data powered by Pitchbook (link) When looking at overall European exits we see the # of deals plateauing, with the average exit being €31MM, aside from outliers in 2018. In the U.S $31MM is the average size of a Series B funding round so Europe is still “emerging” with good pricing but it’s very far from being mature. Source: European Venture Report 2019 Annual, Pitchbook If we take an even closer look at a different set of data we see again, outliers aside, $31MM is the acquisition sweetspot for European companies which makes sense in general because statistically companies $100MM or under have a greater chance of being acquired due to corporate affordability. We can infer from this the EU acquisition $ averages will go up but the total market cap is likely €75BN Source: State of European Tech 2019, Atomico / Dealroom WHO ARE THE LPS OF EUROPE? If we know that funding is happening in Europe as well as exits, but we also know that EU pensions are not even 0.01% engaged with venture capital, and European family offices only make up about 3BN a year for venture in Europe, then who are all the LPs of Europe? Again we know 70% or more of EU venture is actually American capital. 11% of American Venture Capital comes from Europe too, so Europe is investing into America, to invest into Europe, in a cycle which mainly profits the U.S. According to several reports including UBS’ Investor Watch Report We know that 65% of founders prefer to start something where they are, that means European founders are founding wherever they are. We also know 7 out of 10 investors want to hedge on “mega-trends” that is why we see many European startups as EU versions or types of companies that do well in America, but this doesn’t always work out the same in Europe. If we look at the demographic of investors for venture, those under 35 tend to be almost twice as likely to embrace change and exert flexibility: Source: UBS Investor Watch Report Year Ahead (LINK) Ironically the average age a manager takes control of a FO is 40-45 years old so we can see here a new wave of managers coming into play and before the next generation takes control wealth is already up 70% Other data sources, Like FINTRX also confirm that the average family office is about $1BN in size. FAMILY OFFICE ASSETS UNDER MANAGEMENT Source: FINTRX Family Office Industry Report, 2019 66% of family offices in the world are based in North America with about 25% being in Europe but if Europe family offices invested 3BN last year into venture capital, this 25% might as well be 0.05% in relevance for venture capital. Source:FINTRX Family Office Industry Report, 2019 If we look towards the U.S to get more insights on how LP and investor categories breakdown we can see quite clearly the common types of investors, as explained by Preqin and First Republic Bank Source:Prequin and First Republic Bank US Venture Capital in Q3 2019 (LINK) The U.S market is pretty clear that the LP base of venture capital usually ends up in four main categories: Foundations, Pensions, Family Offices, and Other. If there’s currently a 50BN opportunity for Europe, and if it is to act similar to the U.S market, that would be 12.5BN per LP category. If we know 3BN of European venture capital is coming from European FOsthen the market is 1/4 maximized in that category alone. It would appear of all the types of LPs EU FOs and EU pensions are likely to have the hardest time getting a slice of the venture capital pie and yet they continue to wait and not sense any investment urgency. SITTING ON THE SIDELINESBy reverse calculating the market opportunity of Europe which is currently at 30BN annually (for venture capital) it is very likely the market will cap out at around 75BN including assumptions for growth, price increases and currency fluctuations. This leaves 45BN unassigned in European venture to be gained upon, again 50BN. With the UK having left the European Union, that means EU venture potential has both cut in half and doubled at the same time and here’s why: on one hand London has always been a major hub for talent and capital, however with the UK out of the EU, talent opportunities have dropped to import skilled workers so mobility has dramatically decreased. On the other hand, taking out British investors as LPs into Europe creates more room for either American’s to take up marketshare or Europeans to finally jump in and get a piece. On a high level that means about 12BN annually has opened up for the EU community LPs to jump on, assuming the Americans do not beat them to it. Below is an infographic which shows how big the UK had been in the European wealth market as compared to several regions and prior to Brexit Source: The Wealth Report, Knight Frank (LINK) If we assume the current European VC market is 30BN, and American capital conservatively accounts for 50% or more of this (say 15BN), and Brexit has taken UK capital off the table for the future (13BN) and startup prices will continue to rise over the coming years (even at a rate of 30%) this would mean there’s about 50BN on the table over the coming years, and specifically all that’s left for European investors! With only 50BN for EU pensions, family offices, individuals and HNW, this is nothing. If the average EU family office invested only 2% of their AUM that would allow for $20MM per family office or room for about 500 family offices to get involved with venture capital. However, its known statistically that often FOs, when they DO invest into venture its closer to 15-30% of AUM. On the conservative side of things, and accounting for room in this 50BN opportunity for pensions and individuals, European venture capital in the future only has room for about 125 family offices to participate. In several simulations that I ran, this number could be as low as 50 slots for FOs. THE GREAT RACE TO MARKETSHAREIf the US venture capital market is the closest in comparison to Europe, we can see both (1) the EU market cap will not surpass 100BN and (2) strategically every few years 10-15BN of American capital is diversified to Europe nearly automatically For example, 2019 data might indicate a ‘decline’ but it also indicates capital was diverted from the US to EU to reduce risk and maximize better European price points. THE ALLURE OF EUROPEAN AFFORDABILITYThe Dutch government estimates that 12,000 additional skilled workers a year are needed to assist with growing and scaling startups. Germany, who’s market is 3x Netherlands would need even more. As a whole, it’s likely that Europe will need 100,000 jobs a year to sustain venture capital growth and scalable companies. Even with EU unemployment at an all-time low (under 4% in most European regions) there still is not enough people to power hyper growth aka “unicorns.” In 2019 Netherlands was home to 12 unicorn companies and Germany 9. Estimates are that Europe has about 30 unicorns in total in its region. The U.S recorded 199 unicorns in its pipeline Referencing these data points, it’s likely that Europe’s unicorn cap in optimal conditions is somewhere around 100 so the EU VC market is 1/3 of the way matured. On a positive note we see European VC funds decreasing in volume (# of funds) and increasing in the capital that is in them. EU VC funds becoming bigger in size is an indicator of market maturity but it’s not a reflection of European operated maturity or labor expertise. This “growth” of European VC is happening on the accord of American capital infusing the market which is helping American investors profits but not necessarily helping the EU. GLOBAL FLOW OF VENTURE CAPITALSo, what does this all mean? In my case it means that I launched my fund backwards: I should have raised the funds in the U.S and deployed them in Europe—versus raising in Europe and trying to deploy globally. It also means Europe is in great danger of not owning its own marketshare or controlling its destiny. It also means that European citizens are missing out on the possible gains that their pensions could be making them by investing into venture capital while also generating jobs. When I review again reports from Netherlands and Europe I see that despite evenmy own efforts to help the ecosystem, European investors have not budged in movement nor understand the gravity of the situation. I moved to Netherlands in April 2017 and nearly three years later do not see any signs on the ground that people are excited and learning about venture capital the way New York does and has in the past. This is presenting itself as quite the awkward situation for fund managers like myself, when we know that fund managers are paid 30% more working in North America vs. Europe: It is also known that funds raising in the U.S can often take 18 months to fill their fund and this is in ideal hyper-fast conditions with investors savvy in the asset product, so I can only imagine European funds need twice as much time (36 months to fundraise) and in this time can miss out on entire vintages and opportunities. It also seems clear to me without a more robust labor force and cultural appreciation for the kind of hard work running Unicorns take, if Europe wants to be a major player in venture capital it will have to come to a compromise with many of its cultural norms. And lastly, when I think about all that I have seen and experienced the last few years it seems obvious to me that if Europe does not quickly become familiar with venture capital and investing into itself it might miss the boat altogether. From a global perspective the EU VC market will continue to grow whether or not European investors figure it out in time, which means the people benefiting the most off European growth are not actually Europeans which explains why there is such slow movement with EU LPs and talent. It also means the European market is at risk of not reaching its potential if those on the ground do not care or understand what’s going on the way other regions do. At the end of the day it seems that Europeans need to be honest with themselves about the 50BN elephant in the room, before the elephant is gone. --------------------------------------------------------------------------------------------- INDUSTRY REPORTS AND CITATIONS:

6 European Venture Report 2019, Pitchbook https://files.pitchbook.com/website/files/pdf/PitchBook_2019_Annual_European_Venture_Report.pdf 7 CBInsights Moneytree report with PWC 2020 https://www.cbinsights.com/research/report/venture-capital-q2-2019/ 8 Managing Venture Capital Relationships 2019, Cachette Capital https://www.slideshare.net/CachetteCapital/managing-venture-capital-relationships 12 German Venture Capital Landscape Report 2020, Whitestar Capital https://www.slideshare.net/JeandeLencquesaing/white-star-capital-2020-german-vc-report 13 European Venture Report 2019 Annual, Pitchbook https://pitchbook.com/news/reports/2019-annual-european-venture-report 14 State of European Tech 2019, Atomico and Dealroom, https://www.atomico.com/presenting-the-2019-state-of-european-tech-report/ 15 UBS Investor Watch Report, Year Ahead, UBS https://www.ubs.com/global/en/wealth-management/chief-investment-office/market-insights/2019/year-ahead.html 16 FINTRX Family Office Industry Report, 2019 https://www.fintrx.com/fintrx-charles-schwab-2020-family-office-report 17 Preqin and First Republic Bank Q3 2019 https://www.firstrepublic.com/~/media/frb/documents/pdfs/innovators/preqin-and-first-republic-update-us-venture-capital-in-q3-2019-v1.pdf 18 The Wealth Report, Knight Frank https://www.knightfrank.com/wealthreport/2019/download 22 UBS family office https://www.ubs.com/global/en/wealth-management/uhnw/global-family-office-report/global-family-office-report-2019.html Comments are closed.

|

common tags |

||||||

RSS Feed

RSS Feed