|

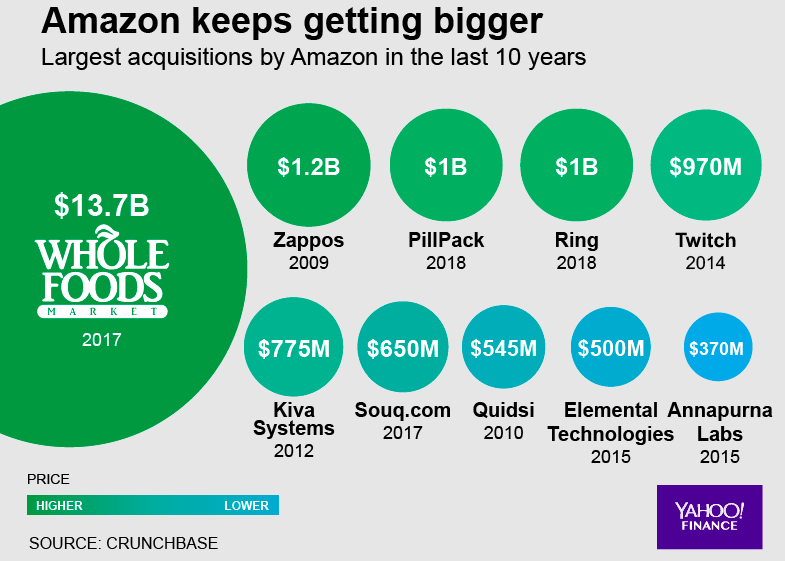

12/8/2020 The Future of Retail is StartupsBy 2009 most large corporate retailers knew they had a problem on their hands: Amazon. While retailers were trying to figure out how to compete, Amazon went on a spending spree buying Zappos for $900MM USD and a half dozen other ecommerce “startups” in a way that not only let it prepare for a series of battles but prepare to win the war. Eventually retailers were onto their core problem with decreasing revenues: consumers were touching and testing products in their retail stores but purchasing online, sometimes even using their mobile phone while standing in a retailer store. We know because all that free in-store wifi could track not only consumers online behavior, but what they were doing offline in the store as well. The tricky part for saving retail from a guaranteed implosion around 2021 would be coming up with a plan within the next 2-3 years from 2009. Giving 2-3 years to test, 2-3 years to roll out quickly across all stores whatever solution that might be. It sounds crazy to think a decade isn’t enough time to produce massive change yet for large corporations its like making a U turn on a narrow cliff. Facebook saw the future of ecommerce by buying Instagram as a moat and WhatsApp as its cross-channel. Amazon did its own prep, making sure it owned Zappos, Ring and Audible all before 2013. Not only could Amazon track your order, it could control the words you listen to and assist your doorstop with a camera to ensure package security, at the consumers cost. This small step is genius in itself-- Amazon took the problem of missing packages and sold the solution back to consumers. The retail heat really kicked up in 2014 when most internal corporate ideas were working at traditional retailers and consumer behavior was changing even faster than data collection could happen. Social media was not going anywhere and costing more for internal marketing; sub brand ecommerce websites growing faster than ever disrupting retail distribution value and consumers too were easily sharing clothing online like with TheRealReal, or temporarily rent a normally very expensive dress with Rent The Runway for just a one-time fee or even test beauty products monthly like with Birchbox. If no major retailer could find “the ultimate solution” to the guaranteed retail apocalypse and have it in place by 2017 survival rates would look slim. Increasing real estate costs mixed with higher consumer foot-traffic (and those costs) than ever, additional capital for online ecommerce marketing, less items being bought in store (sales down), SEO getting more competitive online (online cost increase), and then sometime between 2017/2018 the CAC or Customer Acquisition Cost for traditional retailers was flipped on its head by successful DTC or direct-to-consumer startups jumping into commerce with little startup costs and max revenue is selling products directly online to consumers, which was inevitable. Now all of a sudden the monopoly that big retailers like Wal-Mart, Macy’s, Sears, Target etc had on brands is no longer relevant. Startups were taking money from retailers and brands were learning how much retailers were “taking” by simply offering products in physical stores. The margins that retailers were taking from brands for simple distribution, were being cut out and given back to brands or consumers in product savings. Online ecommerce was no longer a fad like a Twitter campaign, entire companies like Warby Parker, Harry’s, M.M LaFleur, Casper etc were now coming into retail with superior products at reasonable prices and sold direct to consumers without even so much as a physical store. Tesla was around too booming with its own electric car sales despite not having many places to test drive a car, and some states like Texas still not okay with that. Startups have been proving for sometime that retail stores no longer have the same purpose-- a physical store location was no longer required for a consumer purchase. Since startups could not afford retail space or the chance at lost dollars in person, they HAD to rely almost entirely first with online sales then secondary with corporate partnerships (ex: American Airlines pilot programmed Casper blankets on its airplanes) cutting out the retail middleman altogether. Tesla was around too booming with its own electric car sales despite not having many places to test drive a car, and some states like Texas still not okay with that. Startups have been proving for sometime that retail stores no longer have the same purpose, and a physical location was unnecessary for a consumer purchase. Since startups could not afford retail space or the chance at lost dollars in person, they HAD to rely almost entirely first with online sales then secondary with corporate partnerships (ex: American Airlines pilot programmed Casper blankets on its airplanes) cutting out the retail middleman altogether. STARTUPS ARE BETTER AT ONLINE COMMERCESuperior Online Marketing Social media caught all retailers off guard and thus much of internal marketing resources were concentrated on online ads and online areas which are now redundant. Whereas startups, who had to learn the leanest way for the most consumer purchases (no clicks) hacked their own routes to their consumer base at nearly a fraction of any cost it would take the same retailer to reach the same consumers. Startups de facto living and breathing online are already their own marketing department even if they only currently have a few products. Further, some startuppy products like Twiliohave become crucial to online deliveries or text confirmations. Faster Product Innovation Smaller teams for decision making, smaller product batches, smaller everything means that startups can change and adapt products in a way that a retailer never could. Startups are agile, aggressive with getting consumer feedback and can even test for consumer sentiment before producing a single thing. If consumers have become more demanding on production, startups are the solution. I remember working on Pilot Programs in 2009, 2013, 2016 for retailers trying to figure out how the new integration worked between retailers and startups. Some of those retailers have figured it out, like how a Swedish startup took $670,000 in investment money and turned it into $2.2MM annual sales, then rolled itself into a major partnership with H and M. Other retailers like Target have certain shelf space set aside for startups like Harry’s etc, exploring a startup “pop up” within their own stores. These collaborations are more reflective of the retailers themself. One might argue other retailers are still relishing in the past, overpaying for 10 year apparel deals for the sake of short-term stock lift when there are thousands of online influencers driving much more in new sales to companies at lower $ rates, thus higher ROI (return on investment). Startups Are Lean and Efficient Once a company’s headcount surpasses even 1,000 it can become impossible to make company-wide decisions quickly. Many startups hit this “stall rate” even around Series B, since scaling requires capital and resources. By default, any innovative solutions for retail will surface as startups… so retailers quickly become startup friendly or startup allergic. The translation of this exacerbates the importance of time, HOW quickly can change be implemented. STARTUPS ARE THE FUTURE OF RETAIL STOREFRONTSThere is Currently a Surplus of Retail Space Retail property owners have long thought about creative ways to use their spaces and since 2012 entrepreneurs have been trying to figure out how to hack the retail space without being obligated to it and startups are not afraid to co-work together so when you add these cultural advantages with the mix of excellent online marketing you get the perfect storm awaiting all the empty, Covid-19 driven vacated store space. Retailers were struggling to keep the machine running prior to DTC startups or a pandemic forcing people to stay home. The only hero with a cape here will be startups doing their own pop-ups in existing retail spaces at the fraction of operational cost. Startups Know How to Test Consumers Retailers are constantly paying big bucks for “data” to understand consumers when the proof might be more in shopping experience itself and what consumers want and need: wifi, an experience to remember, and a connection to a product or products. Startup Perch Interactive works with large retailers for in-store “engagement” which could also be applied for future startup pop ups. Meanwhile, we see brands buying hardware startups like lululemon did with Mirror likely to innovate its own stores and colleges designing new robots to assist retail— what’s exciting about all this innovation being built withstartups are leading the way. The Power of Data Startups know how to max the data they learn from small groups (they call it beta testing) to learn and interact to become even BETTER at innovation. There are now startups focusing on shipping, labeling, selling, seeking, reducing waste, reducing time and nearly all areas of efficiently that need to be built out to accommodate how drastically consumer behavior is changing as related to retail. I even know startups focusing ONLY on how to optimize shipping out using existing carriers like UPS already, shortening delivery paths and thus time, gas, and materials. Retail Stores As the New Town Centres While it is hard to say for certain the future of community in a post-Covid world, everyone knows it will look completely different from a shopping perspective. In one secret corporate interview, the retailer asked me what their stores (known mostly for home items) would look like if they pivoted into a healthcare company, meanwhile Wal-Mart has thought about turning their parking lots into theatres, and a popular Canadian grocer became its own farm. The retailers are still testing, while Amazon bough Whole Foods in 2017 steps and years ahead. AMAZON WILL WIN ANYWAYDespite all the efforts, whether it’s the startups hustling to be acquired by a retailer or acquired by Amazon directly the most successful startups are likely to find corporate homes within Amazon. For the large retailers, who with certainly will be forced to reduce their workforce nearly 70% to accommodate the changes in their business models, even if they work or acquire enough startups to bring them back to 2017 profit numbers, retailers best outcomes will be getting acquired by Amazon and converting their stores into new localized amazon hubs. The only choice it seems is if retailers control their acquisition or not. Amazon has already begun to construct how to turn deserted malls into distribution centers and while they claim its merely for distribution who is not to say these malls may end up being full of startup pop up centers? Amazon has also already been vetting and meeting with startups, its only a matter of time before distribution isn’t just boxes its products and people. One way to tell this is an ecosystem that is surely to continue building out is that financiers like ING are even offering financing to startups working with Amazon so the layers of support, even financial build around. Right now it’s the holidays, a pandemic, and stores are closing and changing. This holiday shopping season is certainly not acting the same as in the past and some retailers do not understand the depth to which they are stuck, so once the dust settles startups will be able to give new life to both retail shopping and consumer behavior in an experience that is likely to be more beneficial to consumers either way. ====================================== CITATIONSAmazon Buys Zappos, NY Times (2009)

https://www.nytimes.com/2009/07/23/technology/companies/23amazon.html Facebook Owns four most downloaded apps, BBC News (2019) https://www.bbc.com/news/technology-50838013 Amazon to Buy Audible, Reuters (2012) https://www.reuters.com/article/us-audible-amazon/amazon-to-buy-audible-for-300-million-idUSN3129158120080131 CBinsights Future of Retail Technology Startups (2020) https://www.cbinsights.com/research/report/retail-technology-startups/ Telsa CEO moves to Texas, CNBC (2020) https://www.cnbc.com/2020/12/02/tesla-ceo-elon-musk-plans-to-move-to-texas-friends-and-associates-say.html American Airlines Partners with Casper, Techcrunch (2017) https://techcrunch.com/2017/09/28/american-airlines-teams-up-with-casper-to-offer-new-in-flight-sleep-products/ Swedish Startup Small Funding, Nordic9 (2019) https://nordic9.com/news/chimi-eyewear-secured-capital-for-an-eyeglasses-online-operation-news7963784599/ Swedish Eyewear Brand Partners with H and M, vogue (2020) https://www.vogue.com/article/chimi-swedish-eyewear-brand-opens-flagship-collaborates-with-h-and-m GAP Signs Kanye West, BusinessInsider (2020) https://markets.businessinsider.com/news/stocks/gap-stock-surges-10-year-apparel-deal-kanye-west-yeezy-2020-6-1029346081 Landlord Retail Store Creativity (2019) https://stratafolio.com/creative-ways-landlords-are-filling-vacant-retail-space/ Sears and Kmart Closing Stores (2020) https://www.forbes.com/sites/warrenshoulberg/2020/07/12/total-sears-and-kmart-store-count-going-down-to-just-95/?sh=5020c2d60eb5 Lululemon Buys Hardware Startup Mirror, NY Times (2020) https://www.nytimes.com/2020/06/29/business/lululemon-buys-mirror.html MIT Making Retail Robots (2020) https://www.cnn.com/2020/07/04/tech/mit-csail-coronavirus-robot-scn-trnd/index.html Wal-Mart Considers Parking Lots As Theatres, CNN (2020) https://edition.cnn.com/2020/07/02/business/walmart-drive-in-theaters/index.html Canadian Store Becomes Its Own Farm (2020) https://returntonow.net/2020/06/18/canadian-grocery-store-grows-its-own-organic-veggies-on-rooftop/ Amazon Turning Malls Into Distribution, BusinessInsider (2020) https://www.businessinsider.com/amazon-looks-to-turn-malls-into-giant-fulfillment-centers-report-2020-8 Amazon Fund Meets with Startups, Wall Street Journal (2020) https://www.wsj.com/articles/amazon-tech-startup-echo-bezos-alexa-investment-fund-11595520249 ING Offers Loans to Companies Working with Amazon, FinExtra (2019) https://www.finextra.com/pressarticle/83130/ing-germany-to-offer-business-loans-to-smes-trading-on-amazon Comments are closed.

|

common tags |

RSS Feed

RSS Feed