|

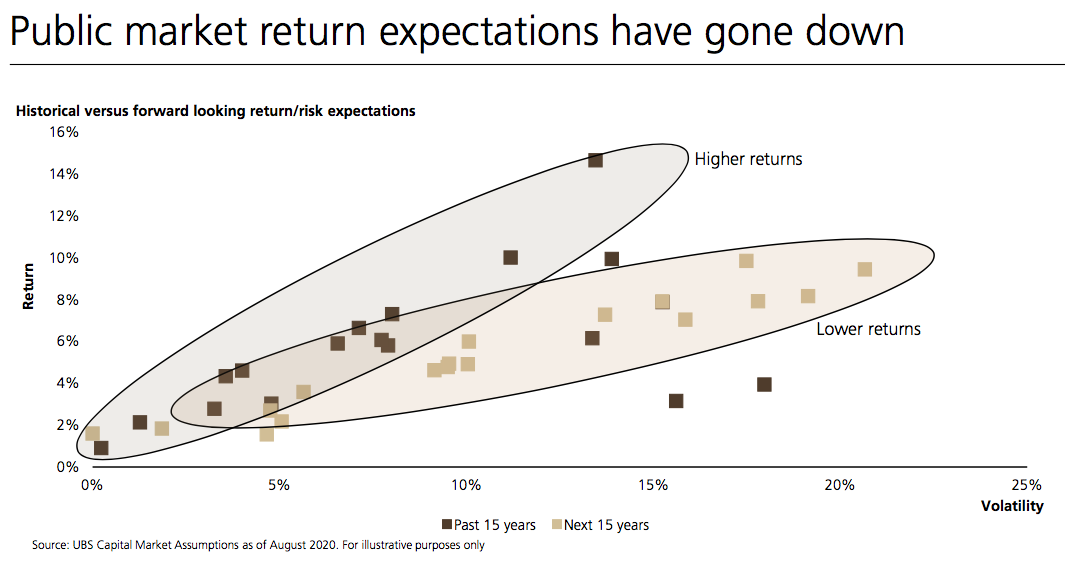

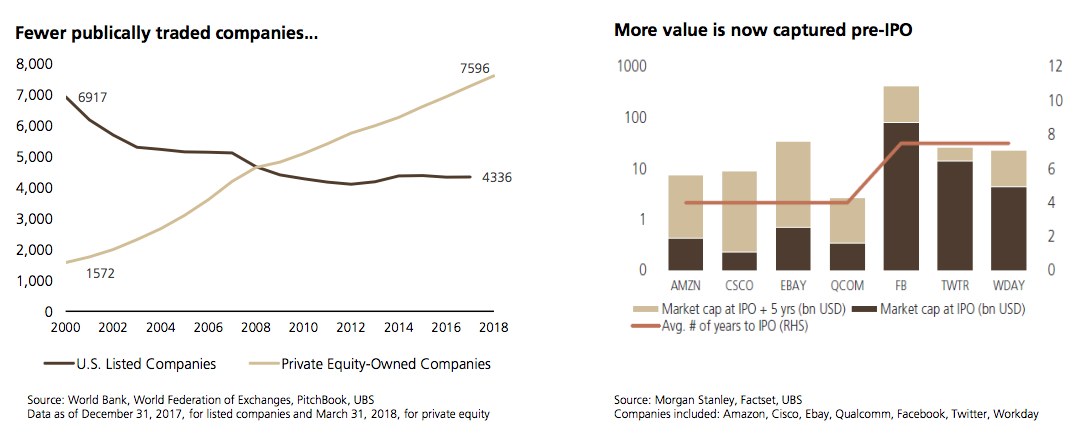

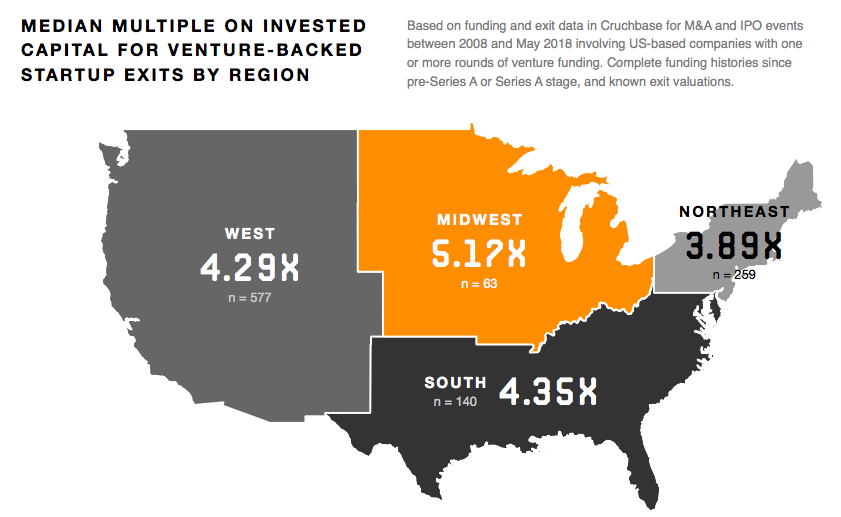

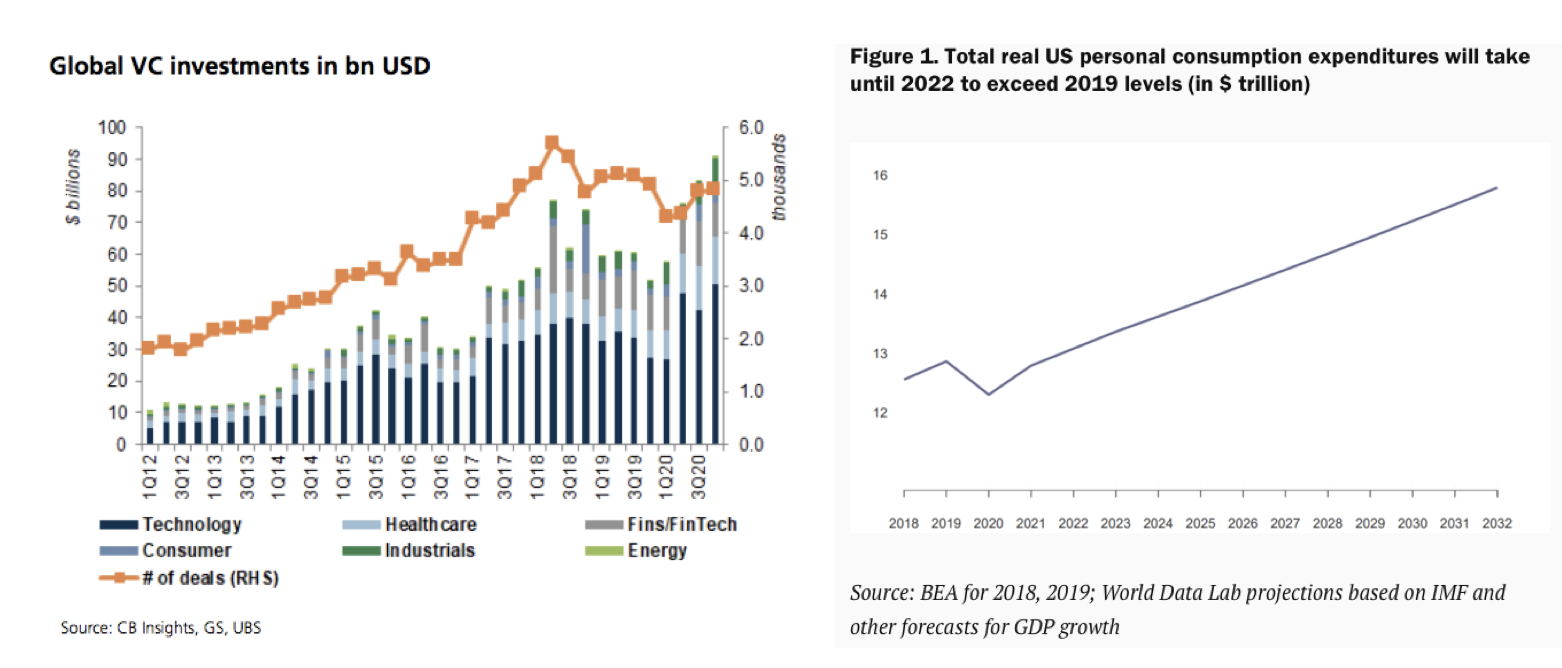

5/5/2021 The Mainstreaming of Venture Capital[THIS POST HAS THE RIGHTS TO BE REPUBLISHED ON REFRESHMIAMI.COM AND NO OTHER SYNDICATIONS] Considering #miamitechweek took the world by storm via Wired.com on Miami and even locals like Austen Bunsen who played along, and went with the flow what is going down in venture capital is something humanity has never seen before. Humans globally have been cooped up for over a year, builders building, and everyone is all of a sudden super familiar with transportation law and clear on what government agency would give them life saving vaccines if needed. The words “domicile” get thrown around a lot just as much as the word “startup” these days. People forget SharkTank the original OG VCs has been on air now over twelve years, that’s more than a decade prior to even Netflix becoming mainstream. When SharkTank aired, Uber was a prototype. Venture capital isn’t a new asset class it’s the natural evolution of consumers and investors “wanting a cut.” This consumer demand surge is putting pressure in a lot of places: for venture as an asset class as a whole, consumers participation into product development (for profit or simply activation), and a huge flip of consumer behaviors post global pandemic. What’s going to happen? More money into venture, more people having equity stakes in the outcome, more interested and caring consumers especially for new or emerging products. Just ask the banks. CONSUMER DEMAND FOR VENTURE As consumers are feeling disappointed by public markets as a whole, banks themselves are reporting increase for demands for alternative investment products, notably the areas which venture capital lives or pre-public stock. Consumers have grown tired of public stocks being late in the market, so much so that overall expectations of public market returns are mainly low which is not always a good thing, as it makes public stocks an asset class less attractive. Or alternatively makes venture capital more appealing. The lack of attraction of public stocks as they exist today has pushed for products like SPACs, which have been around since the 1990s and have made a comeback as a way to give the average Joe or Jane a seat at the investor table, “…consumers are always looking for outlets for getting better returns without the constraints of a traditional investment advisor--where extra fees are paid.” Jonathan Carvalho Pruna, a New York based banking analyst went on further “SPACs have been a recent way for consumers to make a hefty return without feeling like they’ve paid too much in fees. Which is always, of course, appealing.” This push onto from consumers to banks for better investing tools is confusing at best, since there is both the demand for digital currencies as well as tools for investing into startups and companies directly. Consumers are also no longer complacent with the returns of their 401ks (and its restrictions), real estate (and its restrictions) or public stocks (and its restrictions) and lack of exposure to startup equity (accredited investor status restrictions which limit consumers) and in many cases without being a direct employee with access to startup equity, there's not many options for the average person to access venture capital, there's further examples where its important to offer equity to people like with the recent Basecamp debacle where politics came up at work and long story short 1/3 the staff resigned. If employees or consumers don’t have a “cut” there is no having it. When the internet tried to save Gamestop stock from imploding, consumers were left with bruises and questions even when organized in mass and on platforms like, Robinhood. If consumers want a financial stake enough to sway corporate decisions, what does that look like and are public stock offerings the best tool to consumer investing anymore? Venture and real estate, sometimes both. Compass went public to rave reviews as well as Coinbase’s IPO, yet the investors from the earliest days are whom would benefit most from this public offering, not the public, initially anyhow. Trends within public stocks start to blur within private equity and consumers wonder how to get into deals earlier. And so there is growth even on the private side looking towards... private investing. DEMAND FOR INVESTING INTO PRIVATE ALL TIME HIGH ENTER ROBINHOOD, DIGITAL COINS, BTC, ANYTHING ON THE INTERNET… A decade ago consumer startups struggled to get mainstream adoption and corporations were weary to sign on “risky” startups, whereas now most major corporations especially retailers have their own corporate venture capital arms. Not as fun or flexible as traditional venture capital funds yet it’s a start. Consumers have proven they want and crave to be part of the product experience. It’s a change in consumer behavior exacerbated by consumer boredom from a pandemic limiting activities and consumers and from this, savings. Conservative estimations place consumers as having saved up over $12.5 Trillion in spending power for 2020, with consumer consumption not expected to “normalize” until 2023 which means all things consumer will only grow in volume and verticals. PIMCO and other large institutions manage at times $3 Trillion on hand, this means that there is a lot of consumer cash-power awaiting to pour into venture capital. It is only inevitable but how to scale it? What do investors think of venture capital? Since data supports there are more privately traded companies (not listed) than U.S public listings, and when the math is really honed-in terms of company value creation, most of that creation is done pre-IPO. Why would one want to invest into a product that has lower returns, less options, and generates least % of company value creation? But interestingly enough venture capital isn’t becoming just mainstream, its spreading into regions which typically have vary different consumers behaviors which show, overall American consumer support for venture backed or new startups will continue to grow steadily: In reaction to consumer-focused companies (beverages, foods, household) consumer changes are off the charts changing verticals and price points, but one thing is certain consumers like having a say. [Beverages: I don’t know what you’re doing but I’m getting 5 pitches a week and I don’t even direct invest?] VENTURE CAPITAL USE... UP. CONSUMER SPENDING...UP The other interesting correlation is the myth that venture capital is somehow not invested or interested back into "the people" the data indicates otherwise: the more profits, exits and market mobility the more capital is re-cycled or poured back into capital. This is likely based upon holistic and tax planning; if profits are deferred many times the taxes can be as well. What ends up happening is more private money floods the market than government money could try, especially with its bureaucracy. Many industry experts forget to highlight this: one of the best nations in this world, Sweden, also has the most % of GDP invested into venture capital. Think about that, can we be Sweden while also LESS capitalistic? I'm not so sure. But if you take bank data and private data, consumers are spending more and more money is coming into venture capital than ever: MARKET REACTIONS TO VENTURE DEMAND, DIVERSITY IS INEVITABLE The traditional financial markets response to this increased venture demand is with Fund-of-Funds, of venture capital funds developing smaller models for more spread for spreading investment across multiple venture capital funds especially smaller ones, particularly as pension funds evolve and start lowering their minimal threshold investments. In human speak: pensions are getting more comfortable investing smaller check sizes into venture capital but still need risk spread. The result of this are new “nano FOFs” as middle road products for giving access to pensions in a faster way than the traditionally long diligence process. VC FOF Cedana Capital announce their new “Nano-fund” essentially a smaller more nimble fund-of-funds for smaller sized venture capital funds particularly those under $15MM in size reinforcing the market need and in a newsworthy example, Ohio Third Frontier invested $13.5MM spread across an angel investing program, hospital program and venture fund Lightship Capital, a black-owned and female operated venture capital fund disruptor funding minority led startups like Healthy Roots Dolls (who sold out from Target like hotcakes) from areas all over the Midwest and south, previously overlooked regions in venture capital; in regards to venture funds adapting to consumer needs comments, Candice Matthews Brackeen of Lightship Capital (which takes cold pitches… startups!) said “there’s plenty of work to do on all sides” referring to consumer innovation and retail participation to help meet the growing and new demands of consumers. Increased market demands for venture capital funds and funded product creates larger opportunities where there were none before: Harlem Capital known for its power lists of emerging venture capitalists closed its Fund II oversubscribed with $134MMin parallel to MaC Ventures $110MM Fund I close, nearly a week apart. Some funds have created packs for deploying capital faster to underserved managers like with Alpaca VCs $2.5MM Diversity initiativeor First Close Partners. Opening up access routes to smaller venture capital funds is crucial to rolling out diverse products that people want, First Close Partners is said to have a focus that “backs venture funds owned by underrepresented managers”with the caveat of helping these emerging managers “get to first close.” DEMOCRATIZATION OF VENTURE CAPITAL, ROOM FOR GROWTH

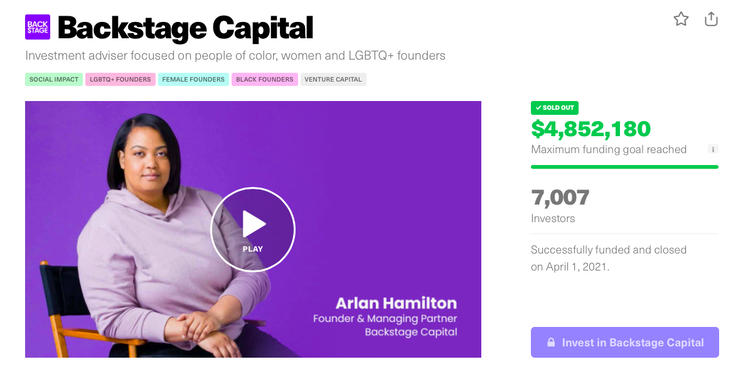

According to most reports its still tricky for female managers to get their hands onto capital at the same rates as men, and are scrutinized more over “traction” than male colleagues but this out-of-date mindset will eventually be flushed out due to all the new founders and managers entering venture from all regions and backgrounds. For example, current DocSend data indicates that potential investors spent 50% more time scrutinizing traction for femalesraising money compared to male cohorts reviewed. Venture capital has the estimated activity of over $125BN each quarter and perhaps up to has $1 Trillion private activity a year. Room for growth in all directions so current bias within fundraising will quickly adjust for the influx of new talent coming into venture capital. Traditional methods often criticized as discriminatory, have been skipped with some funds raising capital online using platforms like Republic. One online fundraising success story is Arlan Hamilton of Backstage Capital who raised $4.85MM on Republic across thousands of investors—but what is overlooked is Backstage powered a whole new set of 7,000 consumers they can message and leverage. New alternatives for fund managers themselves pop up daily and these platforms along with Angellist Syndicates is only the beginning, they change weekly. (I do not support using Angellist syndicates as a product and as a Fund-of-Funds manager) On the Florida front, the Mayor of Miami seems to be gearing up for the drove of thousands of new residents and people excited about entrepreneurship. Some buildings in parts of Miami are reporting hundreds of new tenants in the last few months, most from the tech and venture industries. Emerge estimates over $2.27BN in transactions happen in the Miamiarea annually and growing so with the new energy coming into the city with a Mayor who has opened arms from other cities (known for “How Can I Help?”) Miami is set to be an interesting playground and startup hub in the coming years building off decades of startup ecosystem already in the mix. As more capital flows into venture and more people interested in the space, and a pandemic slowly lifting there is set combination of builders (and consumers) ready for massive innovation. Contrary to some online narratives, the growth of venture capital is actually the process of making it more democratic. In a world where consumers actually have MORE say, what could go wrong? [PS- Miami people we are having a flashmob Sunday May 9that 12:00pm in Midtown, locals are meeting at 11am Tap42. Be there or be square] [Might delete later] ABOUT ME: Friendly asset manager based in Miami, Florida. I love venture capital, startups and pretty much anything consumer @ecachette on Twitter I take cold pitches Comments are closed.

|

common tags |

RSS Feed

RSS Feed